We research all the brands mentioned and may receive a fee from our partners. Research and financial concerns may impact how brands are presented. Not every brand is included. Learn more.

Welcome to my new Goldmoney review.

We’ll be talking about their pros and cons, fees, reviews, and a lot of other stuff.

So, let’s not waste any time and begin:

Are Your Retirement Savings Over $50,000?

Looking to protect your investments from inflation? Diversify your portfolio with a Gold IRA. Secure your assets by investing in gold coins, bars, and bullion. Starting is simple – click on your state now and take the first step toward a more secure financial future!

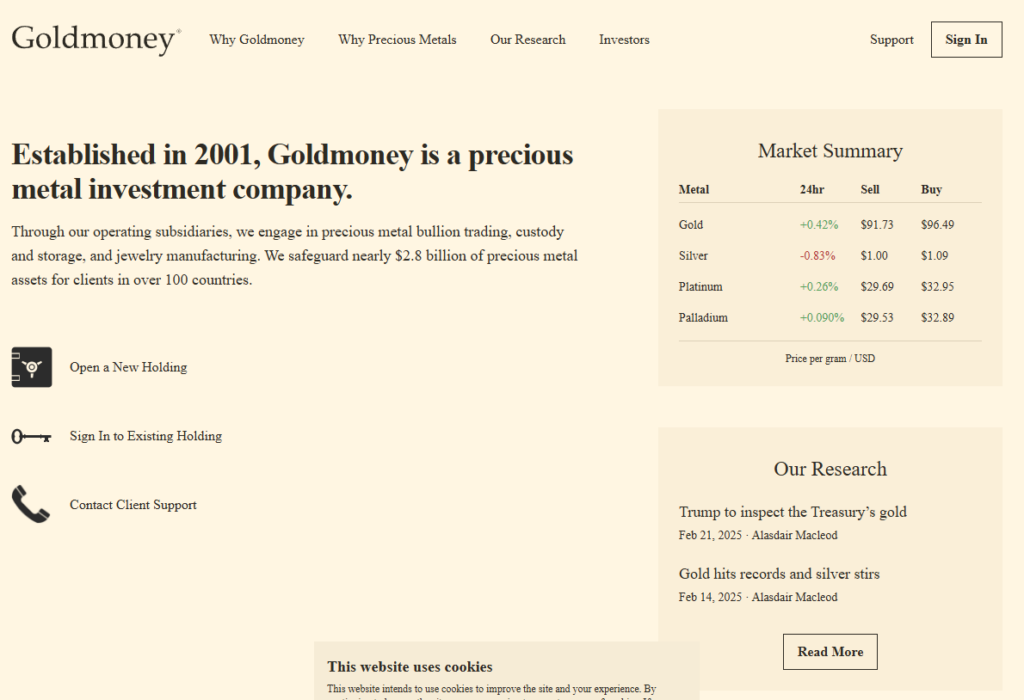

Overview of Goldmoney

Alright, let’s delve into the leadership, location, and history of Goldmoney—a company that’s made waves in the precious metals investment arena.

Leadership

Roy Sebag: The driving force behind Goldmoney, Roy Sebag is the Founder and Chief Executive Officer. Born on June 28, 1985, this Israeli-Canadian entrepreneur has a knack for contrarian investing.

Before Goldmoney, he founded BitGold in 2014, a digital gold payments platform that later merged with Goldmoney in 2015. Beyond this, Sebag co-founded Menē Inc. in 2016, a luxury online jewelry venture crafting pure 24-karat gold and platinum pieces. His diverse career spans technology, precious metals, manufacturing, mining, agriculture, and investment management.

James Turk: Serving as the Lead Director, James Turk co-founded the original Goldmoney in 2001 alongside his son, Geoff Turk.

With a career kickoff at Chase Manhattan Bank, Turk’s experience spans assignments in Thailand, the Philippines, and Hong Kong.

He also managed the Commodity Department of the Abu Dhabi Investment Authority and has held various advisory roles in money management. citeturn0search6

Josh Crumb: As the Co-Founder and Chief Strategy Officer, Josh Crumb brings a wealth of experience.

Before Goldmoney, he was a senior metals strategist at Goldman Sachs and co-founded BitGold with Sebag. Crumb’s academic background includes a Master of Science in Mineral Economics and a Bachelor of Science in Engineering from the Colorado School of Mines.

Location

Goldmoney’s headquarters are nestled in Toronto, Ontario, Canada, specifically at 334 Adelaide St. West #307, Toronto, Ontario, M5V1R4.

In a move to blend digital convenience with physical presence, Goldmoney unveiled its first brick-and-mortar branch on November 1, 2017, in Toronto’s Yorkville area at 38 Avenue Road. This space offers clients in-person services, educational resources, and a tangible connection to their investments. Plans were also in motion to expand with branches in St. Helier, Jersey, Channel Islands, and other major cities worldwide.

History

The journey began in 2001 when James Turk and his son Geoff founded the original Goldmoney, aiming to provide a platform for digital gold-based financial services.

Fast forward to 2014, Roy Sebag and Josh Crumb launched BitGold, envisioning a digital gold payments platform.

This vision materialized in May 2015 with the platform’s launch. A strategic move followed in July 2015 when BitGold acquired the original Goldmoney, merging their strengths and rebranding the parent company as Goldmoney Inc. citeturn0search7

Demonstrating adaptability, Goldmoney ventured into the cryptocurrency realm in November 2017, offering clients the ability to trade Bitcoin. However, by March 2019, the company decided to exit the cryptocurrency market, refocusing on its core mission of precious metals investment services.

In essence, Goldmoney’s trajectory showcases a blend of innovation and tradition, striving to make precious metals-backed savings accessible in the modern financial landscape.

Goldmoney Features

Let’s be honest. The financial system is a house of cards. It’s propped up by government debt, central banks printing money out of thin air, and a bunch of suits pretending everything’s fine while inflation eats away at your savings like termites on a wooden house. If you’re sick of that nonsense and you actually care about real wealth—not fiat funny money—GoldMoney is one of the few sane options left.

So what makes GoldMoney different? Simple. It’s a platform that lets you own real, physical gold and silver. Not some paper derivative, not a “gold-backed ETF” that’s basically a scam, but actual, tangible metal stored in high-security vaults across the world.

You Actually Own Gold, Not a Fake Claim on Gold

Most so-called “gold investments” are a joke. When you buy a gold ETF or some “digital gold” nonsense, you don’t own anything. You own a piece of paper that says you sort of have a claim on gold that might be there if the system doesn’t collapse first. Good luck cashing in on that when things go south.

GoldMoney, on the other hand, lets you buy real gold that exists in a vault, allocated specifically to you. It’s not co-mingled with other investors’ assets. You want to take delivery? Go ahead. They’ll send you your gold bars.

Global, Insured Vault Storage – Your Gold, Your Choice

Let’s say you don’t want to deal with storage, security, or moving gold around yourself. GoldMoney gives you access to vaults in Switzerland, Canada, the UK, Singapore, and more. Your gold sits there, fully insured, protected, and audited.

And here’s the kicker: unlike banks, GoldMoney doesn’t rely on some overleveraged financial institution that could go under tomorrow. Your metal stays safe no matter what happens in the stock market, banking system, or Federal Reserve’s next reckless policy decision.

Third-Party Audits—Because Trust, But Verify

Unlike the U.S. Treasury, which hasn’t had a proper audit of its gold reserves in decades (because they don’t want you to know the truth), GoldMoney actually gets audited regularly. Third-party firms check that every ounce of metal is exactly where it should be, down to the gram.

They even let you verify your specific holdings. So you don’t just hope your gold is there, you know it is.

Gold-Backed Transactions – Pay People in Real Money

In a world where governments manipulate currencies, wouldn’t it be nice to have a way to actually use gold as money? GoldMoney offers a system where you can send and receive payments in gold. That’s right—real, honest money changing hands, not this inflated garbage the Federal Reserve prints at will.

Some of their past services included prepaid gold-backed debit cards, but even without that, you can still use GoldMoney to store your wealth in gold, then cash out in fiat whenever you need to.

Convert to Fiat or Crypto, Because Freedom Matters

Want to convert your gold into U.S. dollars, euros, or another fiat currency? Easy.

Want to hedge your bets and diversify into crypto? They’ve offered that option, too.

The point is, GoldMoney gives you flexibility. You aren’t stuck in a rigged system where your only choices are worthless paper money or stocks inflated by Fed policy.

No Banks, No Middlemen, No Counterparty Risk

Let’s be real: banks are not your friend. They’re a government-backed racket that siphons off your wealth through inflation, fees, and market manipulation. The second there’s a crisis, they freeze accounts, impose withdrawal limits, or flat-out take your money (hello, Cyprus).

GoldMoney operates outside that system. Your gold is not sitting on some bank’s balance sheet. It’s yours. Period.

Gold That Pays Dividends? Yeah, That’s a Thing

Through their Lend & Borrow Trust, GoldMoney even lets you earn returns on your gold holdings by lending against them. Now, this isn’t for everyone, but the point is—they’re thinking beyond just storage. They’re looking at ways to make gold work like real money again.

No Minimum Investment—Because Wealth Protection Shouldn’t Be Just for Elites

Most people think gold ownership is only for rich guys stacking kilos in a vault somewhere. Not true. GoldMoney lets you start small, stacking even fractional amounts of gold until you build real, lasting wealth.

If you trust the government, the Federal Reserve, and Wall Street to protect your financial future, then hey—go ahead and stick with fiat money and traditional banks. But if you actually pay attention to how things are going, you already know you need a Plan B.

GoldMoney isn’t a “trading platform” or a get-rich-quick scheme. It’s a way to exit the scam system and store your wealth in something real, something timeless, and something that governments can’t devalue overnight.

Because at the end of the day, gold doesn’t need a central bank, a politician, or a bail-out. Gold is gold. And that’s why it’s been real money for 5,000 years—long before fiat money existed and long after it collapses.

Sounds like common sense? That’s because it is.

Make the Right Choice

Check Out My Top Recommendations

Goldmoney Products and Services

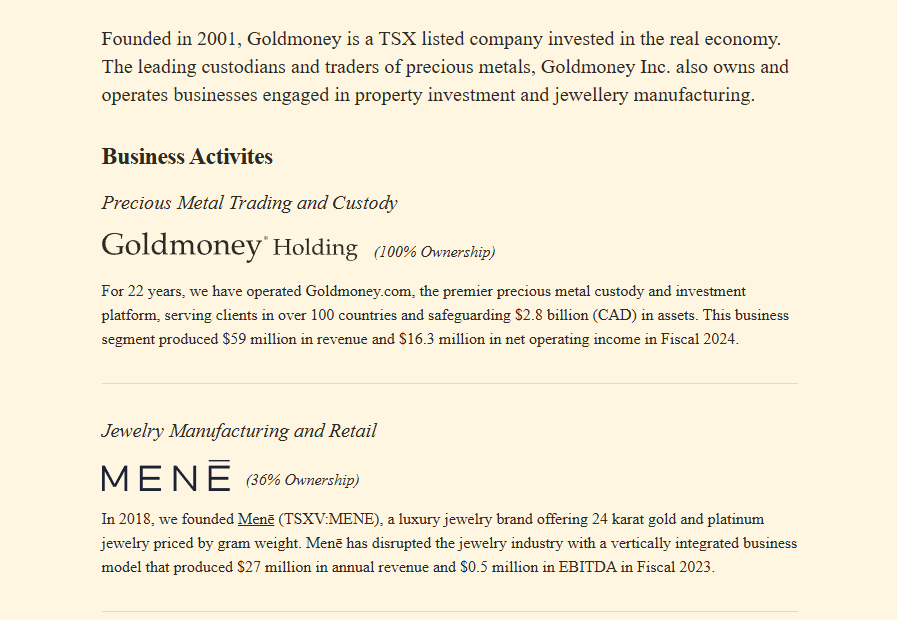

GoldMoney Holding – The Core Account for Precious Metal Ownership

Think of the GoldMoney Holding account as your Swiss Army knife for precious metals. It’s not a basic brokerage account or a simple app that lets you “buy gold” without ever touching it. This is your personal vault account that lets you buy, sell, hold, and even transfer real gold, silver, platinum, and palladium.

Key Features of GoldMoney Holding:

- Buy and Sell Metals – Gold, silver, platinum, and palladium, all fully allocated (meaning you actually own it, not just a paper promise).

- Vault Storage – Your metals are stored in high-security vaults across the world (Switzerland, Canada, Singapore, UK, etc.).

- Multi-Currency Support – Hold and convert between multiple fiat currencies (USD, EUR, GBP, CAD, etc.).

- International Transfers – You can send and receive money internationally using your Holding account.

- Full Transparency & Audits – Regular third-party audits to ensure that every ounce of metal is accounted for.

This is the foundation of everything GoldMoney does—if you want to own gold outside the banking system, this is the best place to start.

Physical Precious Metal Ownership – Real Gold, Not Paper Gold

Most so-called “gold investments” are not actually gold. They’re paper derivatives, ETFs, or IOUs that rely on a broken financial system. GoldMoney is different because when you buy gold or other metals here, you own the actual metal.

Your Options for Physical Gold Ownership:

- Allocated Storage – Your gold is stored in vaults under your name, fully segregated from company assets.

- Physical Delivery – Want to hold your gold in your hands? You can request physical delivery of your metal whenever you want.

- Secure, Insured Storage – Unlike banks that can freeze accounts or confiscate assets, GoldMoney’s vaults are independent and protected.

If you believe in real money, not just numbers on a screen, this is how you actually own wealth in a tangible form.

GoldMoney Wealth – A High-Net-Worth Solution for Serious Investors

If you’re moving serious amounts of wealth into precious metals, GoldMoney Wealth is their premium service for high-net-worth individuals.

What You Get with GoldMoney Wealth:

- Dedicated Relationship Managers – Personal advisors to help with large transactions, vault selection, and estate planning.

- High-Value Transactions – Special pricing and services for large purchases and institutional-level investors.

- Personalized Vault Storage – Custom solutions for vault allocation, metal diversification, and strategic gold holdings.

- Private & Secure Transactions – Unlike traditional banking, your gold holdings are not subject to the same counterparty risks.

If you’re looking to protect a serious amount of wealth, this is how you do it outside of the fiat casino.

Lend & Borrow – Use Your Gold as Collateral for Loans

One of the biggest problems with gold ownership in the modern financial world is liquidity. You might own a ton of gold, but what if you need cash without selling it? GoldMoney has a solution:

Gold-Backed Loans – Borrow Against Your Gold

- Instead of selling your gold, you can borrow money against it.

- Your gold remains in secure storage while you access liquidity.

- Lower interest rates compared to unsecured loans, because your gold is solid collateral.

- No credit check—your collateral is your credit.

This is how gold works as real money. It gives you flexibility without forcing you to return to fiat.

Physical Precious Metals IRA – Retirement That Actually Holds Value

If you’re relying on government-controlled retirement accounts, you’re betting your future on a system that’s being inflated away every single year. GoldMoney’s Precious Metals IRA lets you put real gold in your retirement account, rather than being stuck with stocks and fiat-based investments.

Why This Matters:

- Tax Benefits – Like traditional IRAs, you get tax advantages by using a gold-backed IRA.

- Physical Metal in a Vault – This isn’t a “gold fund” full of paper contracts—it’s actual metal stored on your behalf.

- Retirement Security – If fiat collapses, your IRA doesn’t go to zero—your gold remains valuable.

If you want real retirement security, putting gold in your IRA is one of the only smart moves left.

GoldMoney Business – Protect Your Company’s Wealth with Precious Metals

For businesses that want to escape the insanity of inflation, currency devaluation, and financial instability, GoldMoney Business allows companies to store corporate wealth in gold instead of holding devaluing cash.

How This Works:

- Companies can hold gold and other metals as reserves.

- Use gold for international transactions (especially useful for avoiding fiat volatility).

- Diversify corporate assets outside of traditional banking.

If you’re a business owner who actually understands the importance of sound money, this is a smart hedge against economic instability.

Physical Gold & Silver Bars & Coins – For Those Who Want to Hold It Themselves

If you want to take your gold out of a vault and physically hold it, GoldMoney offers direct purchase of bars and coins.

Your Options:

- Gold & Silver Coins – American Eagles, Canadian Maple Leafs, and more.

- Gold & Silver Bars – Different sizes depending on your investment goals.

- Secure Insured Shipping – Your metal is shipped directly to you with full insurance.

This is perfect for people who don’t trust anyone with their gold and want to hold real money in their hands.

Goldmoney Costs and Fees

Alright, let’s cut through the noise and get straight to the brass tacks about Goldmoney’s fees and costs. If you’re serious about owning real, physical gold and not just playing with paper promises, you need to know what it’s going to cost you. Here’s the breakdown:

Buying and Selling Fees – The Cost of Ownership

- Transaction Fee: Every time you buy or sell precious metals on Goldmoney, they charge a 0.5% fee.

- Example: If you’re purchasing $10,000 worth of gold, you’ll pay a $50 fee.

Storage Fees – Keeping Your Metals Safe

- Minimum Monthly Fee: There’s a $10 minimum monthly storage fee for all accounts, regardless of your balance.

- Why? This ensures they cover the costs of audits, governance, and compliance with KYC and AML regulations.

- Annual Storage Rates:

- Gold: 0.18% per year

- Breakdown: That’s 0.015% monthly.

- Silver: 0.49008% per year

- Breakdown: Approximately 0.04084% monthly.

- Platinum: 0.59004% per year

- Breakdown: Roughly 0.04917% monthly.

- Palladium: 0.979992% per year

- Breakdown: About 0.081666% monthly.

- Note: These rates are competitive, especially when you consider that ETFs often charge 0.4-0.6% annually, which is three to four times higher than Goldmoney’s fees.

- Gold: 0.18% per year

Withdrawal Fees – Accessing Your Funds

- Bank Wire Withdrawals:

- Fees:

- USD: $25 per transfer

- EUR: €25 per transfer; €10 for SEPA transfers

- GBP: £20 per transfer; £7 for Faster Payments/CHAPS

- Other Currencies: Fees vary (e.g., CAD $35, CHF 25, JPY ¥3,000).

- USD: $25 per transfer

- Processing Time: Up to 5 business days for international wires.

- Note: Your bank might tack on additional fees upon receiving the wire.

- Fees:

4. Physical Metal Redemptions – Holding Gold in Your Hands

- Eligibility: To take physical possession directly from the vault, you need to own at least 1 kilogram of gold or 1,000 ounces of silver.

- Fees: Any associated costs, including shipping and insurance, will be disclosed at the time of your request.

5. Additional Considerations

- Inactivity Fees: While Goldmoney doesn’t explicitly mention inactivity fees, it’s wise to maintain regular account activity to avoid any potential charges.

- Currency Conversion Fees: If you’re dealing in multiple currencies, be aware of potential conversion fees when funding or withdrawing from your account.

Check Out My Top Gold IRA Companies

Customer Reviews of Goldmoney

Alright, let’s cut through the fluff and get straight to the heart of the matter regarding Goldmoney. If you’re considering entrusting your hard-earned wealth to this platform, you deserve the unvarnished truth. Here’s what the real users are saying:

Sitejabber: A Cascade of Complaints

- Overall Rating: A dismal 1.3 out of 5 stars, based on 88 reviews.

- Common Grievances:

- Customer Service: Users repeatedly describe it as unresponsive and unhelpful.

- Hidden Fees: Many investors feel blindsided by unexpected charges that erode their investments.

- Account Issues: Reports of accounts being locked or closed without clear justification are alarmingly frequent.

User Testimony:

“Goldmoney’s fee structure is designed for the active trader only. If you do not trade sufficiently every month, before long, your holdings will disappear in no time.”

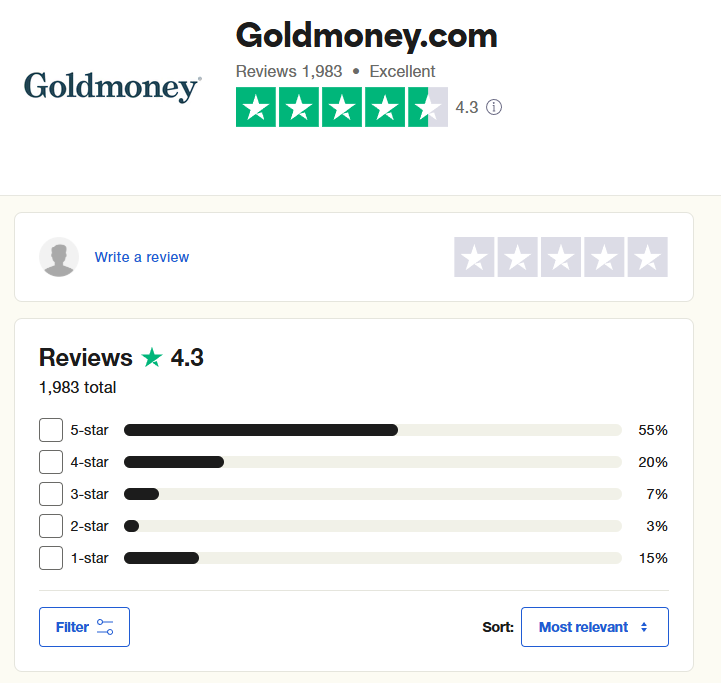

Trustpilot: Great Ratings

- Overall Rating: A concerning 4.3 out of 5 stars, based on 1000+ reviews.

- Customer Service: Users repeatedly describe it as excellent.

- Accessible: Many users praise Goldmoney for its accessibility and helpful interface.

Better Business Bureau (BBB): An ‘A+’ Rating

- Rating: An A+ that doesn’t tell the full story.

- Accreditation: Goldmoney isn’t BBB accredited.

- Customer Feedback: A scant number of reviews but most of them are positive.

Insight: An ‘A+’ rating inspires confidence among consumers.

Reddit: The Unfiltered Truth

- Community Sentiment: Redditors don’t hold back, and the consensus isn’t flattering.

- Highlighted Concerns:

- Documentation Demands: Users are frustrated with excessive and intrusive documentation requirements.

- Fund Accessibility: Stories of delayed or denied withdrawals are common, leading to financial stress.

- Trust Issues: A pervasive sense of skepticism, with some users outright labeling the platform as a scam.

User Testimony:

“I foolishly trusted these scammers without proper research… after making payment I was blocked by these people.”

YouTube: Visual Red Flags

- Content Creators’ Warnings: Several YouTubers have taken to their platforms to caution potential users.

- Primary Issues Raised:

- Opaque Fee Structures: Hidden fees that catch users off guard.

- Customer Service Failures: Inadequate support during critical issues.

- Withdrawal Obstacles: Challenges in accessing one’s own funds.

Advice: Before entrusting your assets to Goldmoney, conduct thorough research. Consider these firsthand accounts and weigh the potential risks. In the realm of precious metal investment, transparency and trust are paramount. Don’t let a gilded facade blind you to the underlying tarnish.

Note: Always consult with a financial advisor and perform due diligence before making investment decisions.

How Investing with Goldmoney Works

Step 1: Opening a GoldMoney Holding Account

This isn’t some quick sign-up where you punch in your email and start trading. Nope, GoldMoney has a multi-step verification process that feels like you’re applying for a security clearance. Why? Because they take AML (Anti-Money Laundering) and KYC (Know Your Customer) laws very seriously.

What You Need to Do:

- Go to GoldMoney’s Website and hit “Open a Holding.”

- Provide your personal details—name, address, date of birth, etc.

- Upload identification documents, such as:

- A government-issued ID (passport, driver’s license, or national ID).

- A proof of address (utility bill, bank statement, etc.).

- Provide financial information (yes, they ask for this too):

- Source of funds (where your money is coming from).

- Employment details (because they want to know how you make your money).

- Wait for verification. This can take several days or even weeks, depending on your country and the documents you submit.

Step 2: Funding Your Account

You can’t just swipe a credit card and start stacking gold. GoldMoney only allows bank transfers—no PayPal, no credit cards, no Venmo.

How to Fund Your Account:

- Link your bank account to GoldMoney.

- Send a bank wire transfer (fees may apply, so check with your bank).

- Wait for the funds to clear. This can take anywhere from a few hours to a couple of business days.

Step 3: Buying Gold (Or Other Metals)

Now we’re getting to the good part: owning actual physical gold, silver, platinum, or palladium.

How to Make a Purchase:

- Log in to your Holding account.

- Choose your metal (Gold, Silver, Platinum, or Palladium).

- Select a vault location (Switzerland, Canada, UK, Singapore, etc.).

- Enter the amount you want to buy (you can buy in grams, ounces, or a fixed dollar amount).

- Confirm the purchase—GoldMoney will lock in the price at that moment.

✔ Done. You now own real, allocated gold stored in a vault under your name.

Step 4: Storing Your Gold

GoldMoney offers fully insured storage in high-security vaults, which means your metals are physically stored and accounted for—not some fractional reserve scam like ETFs.

Vault Locations Available:

- Zurich, Switzerland (for those who don’t trust governments)

- Toronto, Canada (for North American investors)

- London, UK (for European access)

- Singapore (for Asian markets)

- Hong Kong (limited availability)

✔ You own the metal, and GoldMoney does NOT lend it out (unlike banks with your cash).

Step 5: Selling Your Gold

Need cash? You can sell your metals anytime directly through GoldMoney.

How to Sell:

- Log in and go to the “Sell” section.

- Select the metal and vault location you’re selling from.

- Choose the amount you want to sell (grams, ounces, or a fixed dollar amount).

- Confirm the sale—GoldMoney locks in the price at the moment of sale.

- Withdraw your money via bank wire transfer.

✔ Money goes back into your bank account. (Minus GoldMoney’s fees, of course.)

Step 6: Taking Physical Delivery (If You Want)

Want your gold in your hands? You can request physical delivery, but there are some conditions.

Physical Delivery Requirements:

✔ You must have at least 1 kilogram of gold (or 1,000 ounces of silver) in storage.

✔ Delivery costs extra (shipping + insurance).

✔ You’ll receive gold bars or coins, depending on what you own.

Step 7: Withdrawing Your Money

If you ever decide to cash out completely, here’s what you need to do:

How to Withdraw:

- Sell your gold (see Step 5).

- Request a bank wire withdrawal.

- Wait for the transfer to process (can take up to 5 business days).

- Check your bank account. (Make sure your bank doesn’t charge extra fees.)

✔ Your money is back in fiat form, ready to use.

Final Verdict: Is GoldMoney Worth It?

If you want to own real, allocated, insured gold that’s stored outside the banking system, GoldMoney is a solid option. BUT—it’s not for everyone.

✔ Good for:

- People who actually understand gold as real money.

- Investors who want to hedge against inflation, currency devaluation, and government incompetence.

- Those who want to store their wealth outside the traditional banking system.

❌ Not for:

- Impatient people who expect instant access to their money.

- Those who don’t read the fee structure and then complain later.

- Anyone who thinks gold investing should be as easy as ordering from Amazon.

If you’re sick of being trapped in the fiat system, GoldMoney gives you a way out. It’s not perfect—customer service gets mixed reviews, and there are fees you need to watch out for—but at the end of the day, owning real gold beats watching your savings get eaten by inflation.