We research all the brands mentioned and may receive a fee from our partners. Research and financial concerns may impact how brands are presented. Not every brand is included. Learn more.

Alright, let’s cut through the noise. When it comes to investing in precious metals, two big names tend to dominate the conversation: Goldco and American Hartford Gold. Both companies promise security, wealth preservation, and a hedge against inflation, but they approach the game differently. So, which one is worth your time—and, more importantly, your money? Let’s break it down.

This is a long analysis. I suggest saving this article for future reference.

My Overall Assessment of Goldco vs. American Hartford Gold Comparison

Both of these seem legit.

I like them.

But, if you’re serious about opening a gold IRA, I recommend checking out the following rankings or browse the market further.

There are plenty of options available. Always keep that in mind.

Are Your Retirement Savings Over $50,000?

Looking to protect your investments from inflation? Diversify your portfolio with a Gold IRA. Secure your assets by investing in gold coins, bars, and bullion. Starting is simple – click on your state now and take the first step toward a more secure financial future!

Goldco vs. American Hartford Gold: Reviews and Ratings Comparison

When it comes to investing in precious metals, customer reviews and ratings are your go-to indicators for trustworthiness and reliability. Let’s take a deep dive into how Goldco and American Hartford Gold stack up, based on what real customers and trusted review platforms have to say.

Overall Customer Reviews

Goldco

- Reputation: Goldco has been in business since 2006, and their longevity shows in the sheer volume of positive customer reviews.

- Customer Sentiment: Customers rave about Goldco’s exceptional customer service, seamless IRA rollovers, and educational support. They frequently mention how the team is patient and never pushy.

- Common Praise:

- Transparent pricing.

- Easy and quick rollover process for IRAs.

- Knowledgeable account managers who guide clients step by step.

- Common Criticisms:

- Some customers find the $25,000 minimum investment for IRAs a bit high.

- Limited product offerings outside of gold and silver.

American Hartford Gold

- Reputation: A newer company, founded in 2015, but has already gained a strong foothold in the market.

- Customer Sentiment: Reviews highlight American Hartford Gold’s friendly customer service, quick delivery for home purchases, and free storage promotions for IRAs.

- Common Praise:

- First-year fee waivers for IRAs.

- Competitive pricing with frequent promotions like free silver.

- Smooth home delivery process for metals purchased outside of IRAs.

- Common Criticisms:

- Some customers report feeling pressured by sales tactics.

- Lack of detailed pricing on their website (you have to call for quotes).

Trustpilot Ratings

Goldco:

- Rating: 4.8/5 (based on thousands of reviews).

- Highlights:

- Customers repeatedly praise Goldco’s transparency and the professionalism of its team.

- Reviews often mention a stress-free IRA setup process and high-quality customer care.

American Hartford Gold:

- Rating: 4.9/5 (based on hundreds of reviews).

- Highlights:

- Many reviews highlight quick delivery, especially for home purchases.

- Customers appreciate the no-fee promotions for new IRA accounts and free silver offers.

Better Business Bureau (BBB) Ratings

Goldco:

- Rating: A+ (Accredited Business).

- Customer Complaints: Very few, and those that exist are resolved quickly.

- Key Takeaways:

- Customers appreciate Goldco’s responsiveness and ability to resolve minor issues efficiently.

- BBB’s accreditation reinforces Goldco’s reliability.

American Hartford Gold:

- Rating: A+ (Accredited Business).

- Customer Complaints: Similarly low, with quick resolution times.

- Key Takeaways:

- Customers praise the company for clear communication and fair resolutions to any issues.

- BBB reviews frequently commend the team for professionalism and follow-through.

Consumer Affairs Ratings

Goldco:

- Rating: 4.8/5 (based on over 700 reviews).

- Highlights:

- High marks for exceptional service and transparency in the IRA setup process.

- Customers frequently mention their confidence in Goldco’s professionalism.

American Hartford Gold:

- Rating: 4.9/5 (based on hundreds of reviews).

- Highlights:

- Customers love the free first-year storage and IRA setup fee waivers.

- Reviews often highlight the efficiency of home deliveries for metals purchased outright.

Google Reviews

Goldco:

- Rating: 4.8/5 (based on hundreds of reviews).

- Notable Points:

- Reviews consistently emphasize Goldco’s smooth IRA rollover process and personalized customer support.

- Customers appreciate how Goldco’s team educates them on the benefits of precious metals without being pushy.

American Hartford Gold:

- Rating: 4.9/5 (based on fewer reviews compared to Goldco).

- Notable Points:

- High praise for transparency in pricing and fee structures.

- Customers frequently mention their satisfaction with promotional offers like free silver.

Make the Right Choice

Check Out My Top Recommendations

Customer Service Comparisons

- Goldco: Known for exceptional service, with a team of knowledgeable account managers who prioritize education and low-pressure interactions. Clients consistently feel supported throughout the process.

- American Hartford Gold: Also praised for friendly and responsive service, though some reviews mention occasional high-pressure sales tactics. Customers still report satisfaction with the overall experience.

Common Themes in Reviews

| Aspect | Goldco | American Hartford Gold |

| Customer Service | Patient, low-pressure, highly professional. | Friendly, but occasional reports of sales pressure. |

| Transparency | Excellent, with clear pricing and no surprises. | Good, but pricing requires a phone call. |

| IRA Setup | Seamless, with full guidance throughout. | Quick and easy, with fee waivers for the first year. |

| Promotions | Free silver for qualifying accounts. | Free silver + first-year fee waivers. |

| Product Range | Gold and silver only. | Gold, silver, platinum, and palladium. |

The Verdict: Reviews and Ratings Winner

Both Goldco and American Hartford Gold are trusted names with glowing reviews, but your choice depends on what you value most:

- Choose Goldco if you want:

- A longer-established company with a proven track record.

- Top-tier customer service with low-pressure sales.

- A focus on Precious Metals IRAs with clear, transparent pricing.

- Choose American Hartford Gold if you prefer:

- More product diversity, including platinum and palladium.

- Fee waivers for your first year in an IRA.

- Quick delivery for non-IRA purchases.

Both companies have stellar reputations, so you can’t go wrong. It’s all about finding the one that aligns with your financial goals and preferences. But one thing’s for sure—either choice is a smart move toward protecting your wealth with precious metals.

Goldco vs. American Hartford Gold: Detailed Product Comparison

When it comes to precious metals investing, the range and quality of products a company offers can make all the difference. Both Goldco and American Hartford Gold have strong offerings, but they cater to slightly different customer needs. Let’s break down their product portfolios and see how they compare.

Gold Products

Gold is the cornerstone of any precious metals investment, and both companies offer an impressive range.

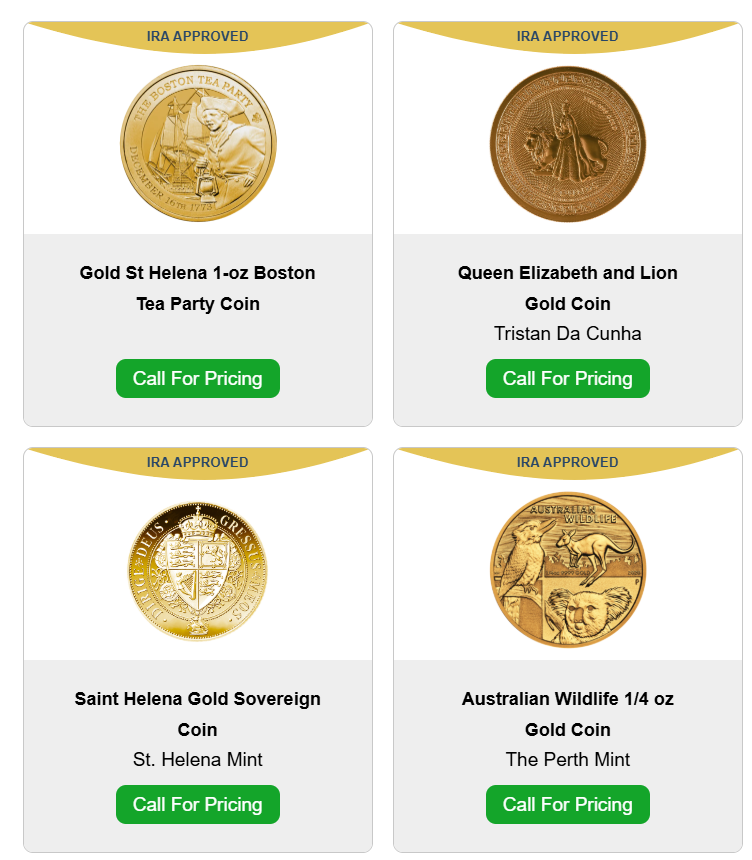

Goldco

- Focus: Specializes in IRS-approved gold products for Precious Metals IRAs.

- Product Range:

- Gold Coins:

- American Gold Eagle

- American Gold Buffalo

- Canadian Gold Maple Leaf

- Australian Gold Kangaroo

- Gold Bars: Available in various weights from trusted refineries like PAMP Suisse and Credit Suisse.

- Gold Coins:

- Quality: Goldco ensures all gold products meet the IRS purity standard of 99.5% for IRAs.

- Standout Feature: Tailored specifically for IRA investors, making it easy to choose products that comply with IRS requirements.

American Hartford Gold

- Focus: Offers both IRS-approved gold for IRAs and a broader range of collectible and investment gold.

- Product Range:

- Gold Coins:

- American Gold Eagle

- Canadian Gold Maple Leaf

- St. Gaudens Double Eagle (collectible coin)

- Austrian Gold Philharmonic

- Pre-1933 U.S. Gold Coins

- Gold Bars: Sourced from reputable mints, available in a variety of weights.

- Junk Gold Coins: Pre-1933 coins with both collectible and investment value.

- Gold Coins:

- Quality: All gold products for IRAs meet IRS purity standards, and collectible coins offer added numismatic value.

- Standout Feature: Broader selection of collectible coins for non-IRA investors.

Comparison:

- If you’re focused on an IRA, Goldco is more streamlined and tailored for compliance.

- For collectors or those looking for rare gold coins, American Hartford Gold has a wider range of options.

2. Silver Products

Silver is a more affordable entry point for precious metals investors, and both companies cater to this market.

Goldco

- Focus: Primarily offers IRS-approved silver products for IRAs.

- Product Range:

- Silver Coins:

- American Silver Eagle

- Canadian Silver Maple Leaf

- Australian Silver Kookaburra

- Austrian Silver Philharmonic

- Silver Bars: High-purity bars in varying weights, ideal for both IRAs and direct purchases.

- Silver Coins:

- Quality: All silver products meet the IRS purity standard of 99.9%.

American Hartford Gold

- Focus: Offers a mix of IRA-approved silver and non-IRA silver for collectors and preppers.

- Product Range:

- Silver Coins:

- American Silver Eagle

- Canadian Silver Maple Leaf

- Austrian Silver Philharmonic

- Silver Krugerrand

- Junk Silver Coins (pre-1965 U.S. coins with 90% silver content)

- Silver Bars and Rounds: Available in multiple weights, from small 1-ounce bars to large 100-ounce bars.

- Silver Coins:

- Quality: Offers both investment-grade silver for IRAs and numismatic silver coins for collectors.

- Standout Feature: A wide selection of junk silver coins, appealing to preppers and collectors alike.

Comparison:

- If you’re looking for junk silver or a wider variety of coins, American Hartford Gold has the edge.

- For pure silver investments tailored to IRAs, Goldco simplifies the process.

3. Platinum and Palladium

For investors seeking to diversify beyond gold and silver, platinum and palladium are excellent options.

Goldco

- Focus: Does not offer platinum or palladium products, focusing exclusively on gold and silver.

American Hartford Gold

- Focus: Offers platinum and palladium products, making it a more versatile option for those wanting to expand their precious metals portfolio.

- Product Range:

- Platinum Coins:

- American Platinum Eagle

- Platinum Bars: High-quality, IRS-approved bars for IRAs.

- Palladium Coins:

- Canadian Palladium Maple Leaf

- Palladium Bars: Available in varying weights for investors seeking rarity and diversification.

- Platinum Coins:

Comparison:

- If you’re interested in platinum or palladium, American Hartford Gold is the clear winner.

4. Collectible and Numismatic Coins

Collectible coins can add a layer of historical or artistic value to your investment, and this is where American Hartford Gold shines.

Goldco

- Focus: Minimal focus on collectibles. Their primary goal is providing metals that comply with IRS standards for IRAs.

- Product Range:

- Limited selection of gold and silver coins with numismatic value.

American Hartford Gold

- Focus: Offers a robust selection of collectible and numismatic coins.

- Product Range:

- Pre-1933 U.S. Gold Coins: St. Gaudens Double Eagles, Liberty Head, and more.

- Junk Silver Coins: Pre-1965 dimes, quarters, and half-dollars.

- Rare and limited-edition coins for collectors seeking something unique.

Comparison:

- If collectible coins are your priority, American Hartford Gold offers significantly more options.

- If you’re focused on pure investment value, Goldco keeps it simple and direct.

5. IRS-Approved Products for IRAs

Both companies excel in offering products that meet the strict IRS requirements for Precious Metals IRAs.

Goldco

- Specializes in gold and silver coins and bars that comply with IRS purity standards.

- Makes it easy to select IRA-compliant products with a streamlined inventory.

American Hartford Gold

- Offers a wider variety of IRS-approved products, including platinum and palladium, in addition to gold and silver.

- Provides more options for investors who want to diversify within their IRA.

Comparison:

- If you want to stick to gold and silver, Goldco is your go-to.

- For broader diversification, including platinum and palladium, American Hartford Gold takes the lead.

6. Promotions and Perks

Both companies offer incentives for new customers, particularly for IRA rollovers.

Goldco

- Free Silver Promotions: Qualifying IRAs can receive up to $10,000 in free silver, depending on the investment size.

- No Hidden Fees: Transparent pricing with clear explanations of IRA and storage costs.

American Hartford Gold

- Free Silver Promotions: Offers free silver with qualifying purchases or rollovers, often with flexible thresholds.

- First-Year Fee Waivers: No setup or storage fees for the first year of an IRA.

- Price Match Guarantee: Ensures you’re getting a competitive deal on metals.

Comparison:

- Both companies offer free silver, but American Hartford Gold’s fee waivers make it particularly appealing for first-time IRA investors.

Final Verdict: Which Is Better for You?

| Category | Goldco | American Hartford Gold |

| Gold Products | Streamlined, IRA-focused. | Broader range, includes collectible coins. |

| Silver Products | Focused on IRAs. | Includes junk silver and collectibles. |

| Platinum and Palladium | Not offered. | Available for IRAs and direct purchases. |

| Collectibles | Limited options. | Strong selection of rare and historic coins. |

| IRS-Approved Products | Gold and silver only. | Gold, silver, platinum, and palladium. |

| Promotions | Free silver for larger rollovers. | Free silver + first-year fee waivers. |

The Bottom Line

- Choose Goldco if you want a straightforward IRA experience focused on gold and silver, with fewer product distractions and a proven track record.

- Choose American Hartford Gold if you value product diversity, collectible coins, or the ability to invest in platinum and palladium.

Both companies are industry leaders, but your choice depends on your investment priorities. Either way, you’re making a solid move toward protecting your wealth with precious metals.

Goldco vs. American Hartford Gold: Fees and Pricing Transparency

When investing in precious metals, understanding the costs involved is crucial. Hidden fees or vague pricing structures can quickly eat into your returns. Both Goldco and American Hartford Gold are reputable companies, but they take slightly different approaches to fees and pricing transparency. Here’s a detailed breakdown of how they compare.

Account Setup Fees

Goldco:

- IRA Setup Fee: $50 one-time fee for setting up a Precious Metals IRA.

- Transparency: Goldco clearly discloses the account setup fee during the onboarding process. This fee is standard for most custodians.

- Perception: Customers appreciate the upfront explanation of this cost.

American Hartford Gold:

- IRA Setup Fee: Waived for the first year as part of their promotions.

- Transparency: While they emphasize the first-year waiver, the fees after the initial year are not clearly outlined on their website and must be confirmed with a representative.

Comparison: Goldco is more transparent about their setup fees, but American Hartford Gold’s first-year fee waiver makes them more attractive for newcomers.

Annual Maintenance Fees

Goldco:

- Custodian Maintenance Fee: $80 annually for account management.

- What’s Included: Covers record-keeping, account statements, and customer support from the custodian.

- Transparency: This fee is disclosed upfront during the consultation process.

American Hartford Gold:

- Custodian Maintenance Fee: Often waived for the first year, but after that, fees can range from $75–$150 annually, depending on the custodian and account size.

- What’s Included: Similar to Goldco, the fee covers administrative tasks like account statements and support.

- Transparency: Post-waiver fees are not explicitly listed on their website and are usually discussed over the phone.

Comparison: Goldco provides more clarity upfront, while American Hartford Gold’s fee waiver can save you money during the first year but leaves future costs less clear.

Storage Fees

Goldco:

- Storage Costs: $100–$150 annually, depending on the depository chosen.

- Non-Segregated Storage: Around $100 per year.

- Segregated Storage: Higher fee ($150), but your metals are stored separately from other investors’ assets.

- Transparency: These fees are disclosed during the consultation, with detailed explanations of the storage options.

- Storage Locations: Goldco partners with trusted depositories like Delaware Depository and Brink’s Global Services, both highly secure facilities.

American Hartford Gold:

- Storage Costs: Waived for the first year, but post-waiver fees are typically competitive with the industry standard ($100–$150 annually).

- Transparency: Specific storage fees are not listed on their website, requiring a consultation for exact details.

- Storage Locations: Partners with top-tier depositories such as Delaware Depository and Brink’s, offering both segregated and non-segregated options.

Comparison:

- Goldco offers clearer pricing for long-term storage, while American Hartford Gold’s first-year waiver is great for cost savings but less transparent about post-waiver fees.

Pricing on Metals

Goldco:

- Transparency: Pricing is tied to the live spot price of precious metals, plus a competitive premium. While specific premiums aren’t listed online, Goldco provides a detailed breakdown during consultations.

- Premiums: Slightly higher due to Goldco’s focus on IRA-compliant metals, which meet strict IRS standards.

- Customer Perception: Clients appreciate Goldco’s honesty in explaining how premiums work and why IRA-eligible metals typically cost more.

American Hartford Gold:

- Transparency: Pricing information is not readily available online—you’ll need to call for a quote.

- Premiums: Competitive with industry averages but vary depending on the product. First-year IRA customers often receive free silver promotions, which can offset costs.

- Customer Perception: Some customers find the lack of upfront pricing inconvenient but are satisfied with the explanations provided during consultations.

Comparison: Both companies operate with a call-to-quote model, but Goldco provides more transparency about why their premiums exist and how they’re calculated.

Buyback Policies

Goldco:

- Buyback Program: Goldco offers a no-hassle buyback program, allowing clients to sell their metals back at competitive prices.

- Transparency: Clear explanation of how buyback pricing is determined, based on the current market value of metals.

- Customer Perception: Clients frequently mention the ease of liquidating assets through Goldco’s program.

American Hartford Gold:

- Buyback Program: Also offers a buyback program but emphasizes home delivery for non-IRA purchases, allowing customers to handle their metals independently.

- Transparency: Similar to Goldco, the program is explained during consultations, but specific buyback terms may depend on the product and purchase size.

- Customer Perception: Reviews highlight satisfaction with the buyback process but note a preference for Goldco’s streamlined approach.

Comparison: Both companies provide strong buyback options, but Goldco’s program is slightly more polished, offering a seamless experience for IRA investors.

Fee Waivers and Promotions

Goldco:

- Promotions:

- Free silver bonuses for qualifying IRA rollovers (up to $10,000 worth of silver, depending on the account size).

- No hidden costs during the rollover or IRA setup process.

- Who Benefits: Best for investors rolling over larger retirement accounts.

American Hartford Gold:

- Promotions:

- Waives all IRA setup and storage fees for the first year.

- Free silver offers for qualifying purchases or rollovers.

- Price match guarantee on metals, ensuring competitive rates.

- Who Benefits: Excellent for first-time investors looking to minimize initial costs.

Comparison:

- If you’re investing heavily and value long-term transparency, Goldco’s silver bonuses are appealing.

- For first-year savings and low upfront costs, American Hartford Gold’s fee waivers are hard to beat.

Minimum Investment Requirements

Goldco:

- Minimum Investment: $25,000 for IRA accounts, which may feel steep for smaller investors.

- Non-IRA Purchases: No minimum investment required.

American Hartford Gold:

- Minimum Investment: No stated minimum for IRAs, making it more accessible to new or smaller investors.

- Non-IRA Purchases: No minimum investment required.

Comparison: American Hartford Gold is more flexible, particularly for smaller investors, while Goldco is tailored for larger, more serious IRA accounts.

The Bottom Line: Which Company Has Better Fees and Pricing Transparency?

| Category | Goldco | American Hartford Gold |

| Account Setup Fees | $50 setup fee, fully disclosed. | Waived for the first year but less clarity afterward. |

| Annual Maintenance | $80 annually, disclosed upfront. | Waived for the first year, fees vary after that. |

| Storage Fees | $100–$150, clear pricing. | Waived for the first year, details depend on account. |

| Metals Pricing | Transparent, premiums explained during consultation. | Competitive but requires a call for quotes. |

| Buyback Program | Seamless, hassle-free. | Reliable but slightly less streamlined. |

| Promotions | Free silver for large rollovers. | Fee waivers + free silver for IRAs and purchases. |

| Minimum Investment | $25,000 for IRAs. | No minimum for IRAs or purchases. |

Final Verdict

- Choose Goldco if you:

- Are rolling over a larger retirement account ($25,000+).

- Want long-term transparency and a polished buyback program.

- Appreciate detailed guidance on premiums and fees.

- Choose American Hartford Gold if you:

- Are a first-time investor or starting with a smaller account.

- Want to avoid setup and storage fees in the first year.

- Prefer a price match guarantee and flexibility with no minimum investment requirements.

Both companies deliver strong value, but your choice depends on your investment size, fee preferences, and need for transparency. Either way, you’ll be working with a trusted name in the precious metals industry.

Goldco vs. American Hartford Gold: Storage and Delivery – Who Does It Better?

Let’s get something straight—when it comes to investing in precious metals, storage and delivery aren’t just afterthoughts. They’re the backbone of protecting your investment. You’re not buying some gadget off Amazon; you’re investing in tangible wealth. So, how do Goldco and American Hartford Gold stack up in the storage and delivery department? Let’s break it down:

Also read: Can I Set Up A Home Storage Gold IRA?

Storage Options: Security That Actually Matters

Goldco

- Focus on IRS-Approved Storage: Goldco takes no chances when it comes to compliance and security. They exclusively use IRS-approved depositories for Precious Metals IRAs, ensuring your assets are safe and in full compliance with tax regulations.

- Top Storage Partners:

- Delaware Depository: One of the most trusted names in the industry, offering:

- Non-segregated storage (shared vault).

- Segregated storage (your metals are stored separately, but it costs a bit more).

- Brink’s Global Services: Yes, the same Brink’s that’s synonymous with armored trucks and vaults. If anyone’s breaking in, they’ll need an action movie budget.

- Delaware Depository: One of the most trusted names in the industry, offering:

- Insurance: Fully insured. If anything happens to your gold while it’s stored, you’re covered.

- Storage Fees:

- Non-segregated: Around $100 per year.

- Segregated: Higher fee, approximately $150 per year.

- Transparency: Fees are explained upfront during consultations—no surprises.

American Hartford Gold

- Flexible Storage Options: Like Goldco, American Hartford Gold partners with IRS-approved depositories to store IRA metals. However, they also emphasize flexibility for non-IRA investors who want to hold their metals at home.

- Top Storage Partners:

- Delaware Depository: A staple for IRA-compliant storage, offering the same non-segregated and segregated options.

- Brink’s Global Services: Another top-tier choice for secure storage, with locations across the country.

- Insurance: Full coverage for all assets stored in their partner depositories.

- Storage Fees:

- First year is completely waived for IRAs (a huge plus for new investors).

- After the first year, fees align with industry standards ($100–$150 annually), but specifics depend on the custodian.

- Transparency: Fee details after the first year aren’t as prominently disclosed; you’ll need to confirm during consultation.

Delivery Options: Getting Your Gold Safely

Goldco

- Focus on IRAs: Goldco primarily deals with storage for IRA accounts, so delivery isn’t a core part of their service unless you’re cashing out or purchasing metals for personal ownership.

- Direct Purchase Delivery:

- Fully insured and discreet packaging—because nobody needs to know what’s in that box on your porch.

- Delivery speed is reliable, but Goldco doesn’t emphasize home delivery as much as American Hartford Gold does.

- Customer Confidence: Customers rarely report issues with delivery, and Goldco ensures you know when your metals ship.

American Hartford Gold

- Home Delivery Specialist: Here’s where American Hartford Gold really shines. They’ve carved out a niche for home delivery, making it a key selling point for non-IRA investors.

- Direct Purchase Delivery:

- Fast, reliable shipping with full insurance.

- Discreet Packaging: Your gold or silver arrives in a plain, unmarked box—no neon signs saying, “HEY, THIS IS GOLD.”

- Free shipping on many orders, depending on your investment size.

- Speed and Reliability: Customers consistently praise how quickly their metals arrive after purchase. This is a standout feature compared to competitors who can take weeks to deliver.

IRS Compliance: No Margin for Error

Goldco

- Strict IRA Focus: Goldco ensures that all gold and silver for IRAs is stored in IRS-approved facilities. They take care of every detail so you stay fully compliant—no risk of penalties or tax headaches.

- No Personal Possession for IRAs: Goldco sticks to the rules: if it’s an IRA, it stays in a depository.

American Hartford Gold

- Same Compliance Standards: Like Goldco, American Hartford Gold ensures all IRA metals are stored in IRS-approved facilities.

- Personal Possession Options: For non-IRA purchases, they promote home delivery, giving you the freedom to store your gold how and where you like. Just remember, keeping metals at home for an IRA is a big no-no with the IRS.

Customer Experience: What People Are Saying

Goldco

- Customer Sentiment: Clients love the simplicity of Goldco’s storage solutions for IRAs. The company handles everything, from recommending depositories to explaining fees.

- Common Praise:

- Professionalism in ensuring all IRS rules are followed.

- Seamless setup of depository accounts for retirement investments.

- Reliable delivery when withdrawing or buying non-IRA metals.

- Common Criticism:

- Limited focus on home delivery for non-IRA purchases, which might not appeal to those who want immediate possession of their metals.

American Hartford Gold

- Customer Sentiment: Home delivery is a fan favorite. Customers frequently mention how quickly and securely their metals arrive.

- Common Praise:

- Fast shipping with discreet packaging.

- First-year fee waivers for IRA storage.

- Flexibility for those wanting to store metals at home.

- Common Criticism:

- Some investors prefer clearer post-first-year storage fee details upfront.

Key Differences Between Goldco and American Hartford Gold

| Feature | Goldco | American Hartford Gold |

| Primary Focus | Secure storage for IRAs. | Both IRA storage and home delivery. |

| Storage Partners | Delaware Depository, Brink’s. | Delaware Depository, Brink’s. |

| Storage Fees | $100–$150 annually, fully disclosed upfront. | First-year waived, then $100–$150 annually. |

| Delivery Options | Insured delivery for personal purchases. | Fast, insured home delivery for non-IRA metals. |

| Flexibility | Primarily focused on IRA-compliant storage. | Strong emphasis on home delivery for flexibility. |

The Bottom Line: Who Wins the Storage and Delivery Battle?

- Choose Goldco if:

- You’re focused on a Precious Metals IRA and want streamlined, fully compliant storage with clear long-term fees.

- You don’t need home delivery as a major feature.

- Choose American Hartford Gold if:

- You value home delivery for non-IRA purchases or want the option to take physical possession of your metals.

- You’re a first-time investor looking to save money with first-year fee waivers.

Both companies are excellent choices depending on your investment goals. Goldco keeps it clean, simple, and IRA-focused, while American Hartford Gold offers more flexibility with a home delivery edge. Either way, you’re locking in real wealth, and that’s a move you won’t regret.

Goldco vs. American Hartford Gold: Customer Support – Who Has Your Back?

When it comes to investing in precious metals, customer support is the make-or-break factor. You’re not just buying a product; you’re making a significant investment in your financial future. You need a company that answers the phone, explains things without a sales pitch, and treats you like more than just a number. So, how do Goldco and American Hartford Gold compare when it comes to taking care of their customers?

First Impressions: Getting Started

Goldco

- Initial Contact: Goldco prides itself on making a great first impression. From the moment you call, you’re paired with a dedicated account manager who walks you through the entire process.

- Focus on Education: The team takes its time to explain everything, from IRA rollovers to the benefits of gold and silver. They’re in no rush to shove a sale down your throat.

- No High-Pressure Tactics: Customers consistently mention that Goldco’s reps are patient, calm, and genuinely helpful, even if you’re just exploring your options.

- Specialized Guidance: If you’re new to Precious Metals IRAs, Goldco excels at breaking down the details, helping you understand IRS rules, and avoiding rookie mistakes.

American Hartford Gold

- Initial Contact: American Hartford Gold is equally friendly, with reps who are polite, professional, and eager to help.

- Educational Materials: They send free guides and resources to help you understand the value of investing in precious metals.

- Some Sales Pressure: While most customers find their initial interactions helpful, a few reviews mention mildly pushy sales tactics, especially when it comes to convincing you to buy sooner rather than later.

- Broad Support: Their team is well-versed in both IRA setup and direct purchases, making them versatile for different types of investors.

Verdict: If you value a low-pressure, highly educational first experience, Goldco takes the lead. American Hartford Gold offers solid initial support but can sometimes lean into sales mode.

Responsiveness: How Quickly Do They Get Back to You?

Goldco

- Proactive Follow-Up: Goldco is known for staying on top of things. If you leave a message or have a question, you’ll hear back quickly—sometimes within hours.

- Dedicated Account Managers: Having a single point of contact means you’re not bouncing between reps. Your account manager knows your history and answers questions without making you repeat yourself.

- IRA Rollovers: For IRA rollovers, Goldco handles most of the paperwork, keeping you updated at every step. No chasing them down for answers.

American Hartford Gold

- Quick Response Times: American Hartford Gold also scores high on responsiveness. Most customers mention they received callbacks or email responses within a day.

- Team-Based Support: Unlike Goldco, you might not have a single account manager, so your interactions could involve different team members. This isn’t a dealbreaker, but it can feel a bit less personal.

- Direct Purchases: For home delivery purchases, customers frequently praise how quickly the team updates them on shipping timelines.

Verdict: Goldco edges out here with its personalized account manager system, but American Hartford Gold delivers solid response times, especially for home delivery customers.

Educational Approach: Are They Actually Helping You Learn?

Goldco

- Top-Notch Education: Goldco goes all in on educating its clients. They explain:

- The benefits of gold and silver.

- The details of Precious Metals IRAs, including IRS compliance.

- Market trends and how they impact your investment.

- Patient and Clear: Reps take their time answering your questions, ensuring you fully understand the process before making decisions. They’re not just selling—they’re teaching.

American Hartford Gold

- Strong Resources: American Hartford Gold also emphasizes education, providing:

- Free guides and kits on precious metals investing.

- Articles and insights on inflation, market instability, and economic trends.

- Slightly Sales-Driven: While they provide plenty of useful information, there’s a bit more emphasis on steering you toward a purchase, which can sometimes feel less educational and more transactional.

Verdict: Both companies focus on education, but Goldco’s patient, consultative approach makes it the clear winner here.

Post-Purchase Support: Are They Still There After You Buy?

Goldco

- Consistent Follow-Up: Goldco doesn’t vanish after the sale. Your account manager stays in touch to ensure everything is running smoothly, whether it’s your IRA account or your physical gold delivery.

- Buyback Assistance: When you’re ready to sell, Goldco offers a straightforward, no-hassle buyback program. Customers rave about how easy it is to liquidate their investments when the time comes.

- Ongoing Market Insights: They provide updates on market trends and offer advice on optimizing your portfolio as the economy evolves.

American Hartford Gold

- Strong Follow-Up: American Hartford Gold also maintains good communication after the purchase, particularly for IRA clients. They check in periodically to ensure your account is working as expected.

- Buyback Program: Their buyback program is praised for its fairness and efficiency, though it’s not as prominently highlighted as Goldco’s.

- Shipping Support: For home delivery purchases, they provide detailed tracking information and follow up to confirm safe delivery.

Verdict: Both companies excel in post-purchase support, but Goldco’s buyback program and ongoing portfolio guidance give it a slight edge.

Handling Complaints: How Do They Respond When Things Go Wrong?

Goldco

- Proactive Problem Solving: Complaints about Goldco are rare, but when they arise, the company handles them quickly and professionally. Customers often mention how their account managers resolve issues without passing the buck.

- BBB Reviews: Goldco has an A+ rating with the Better Business Bureau, and most complaints are resolved to the customer’s satisfaction.

American Hartford Gold

- Responsive Complaint Handling: American Hartford Gold also has an A+ BBB rating, with very few complaints. When issues arise—usually around shipping delays or minor miscommunications—they respond promptly and work toward a resolution.

- Customer Feedback: While most reviews are glowing, a few customers have mentioned a slightly pushier approach during follow-ups or initial calls.

Verdict: Both companies have strong records of handling complaints, but Goldco’s dedicated account managers provide a more streamlined experience when resolving issues.

Common Customer Praise

| Goldco | American Hartford Gold |

| “My account manager was patient and answered all my questions.” | “Their team was friendly and shipped my gold quickly.” |

| “The IRA rollover process was seamless—Goldco took care of everything.” | “The first-year fee waivers made getting started so easy.” |

| “They kept me updated every step of the way, even after the purchase.” | “Delivery was fast, and the packaging was discreet.” |

Common Customer Complaints

| Goldco | American Hartford Gold |

| Some customers feel the $25,000 IRA minimum is too high. | A few complaints about pushy sales tactics during initial calls. |

| Limited focus on non-IRA purchases, with less emphasis on home delivery. | Less transparency about storage fees after the first year. |

Final Verdict: Who Wins the Customer Support Battle?

| Category | Goldco | American Hartford Gold |

| Initial Contact | Friendly, patient, low-pressure. | Friendly, but occasionally sales-driven. |

| Responsiveness | Excellent with dedicated account managers. | Great response times but less personal. |

| Educational Focus | Deeply educational, focused on learning. | Strong, but leans toward sales occasionally. |

| Post-Purchase Support | Outstanding buyback program and follow-ups. | Strong, especially for home delivery customers. |

| Complaint Resolution | Proactive and efficient. | Responsive, but not as personal. |

The Bottom Line

- Choose Goldco if:

- You value a highly personalized experience with a dedicated account manager.

- You want patient, educational support without feeling pressured.

- You’re focused on IRA rollovers and long-term portfolio management.

- Choose American Hartford Gold if:

- You’re looking for friendly, fast service with a focus on home delivery.

- You’re a first-time investor who values promotions like fee waivers.

- You’re comfortable with occasional sales-driven interactions.

Both companies excel in customer support, but Goldco’s dedicated approach and educational focus give it the edge for IRA investors, while American Hartford Gold’s speed and flexibility make it ideal for those wanting direct purchases or home delivery. Either way, you’re in good hands.

Goldco vs. American Hartford Gold: Promotions and Perks Comparison

When it comes to investing in precious metals, promotions and perks can make a big difference, especially if you’re a first-time investor or rolling over a significant amount into a Precious Metals IRA. Both Goldco and American Hartford Gold offer attractive perks to sweeten the deal, but they take slightly different approaches.

Free Precious Metals Offers

Goldco

- What They Offer:

- Goldco is known for its free silver promotion for IRA rollovers.

- Depending on the size of your investment, you could receive up to $10,000 worth of free silver.

- How It Works:

- Qualifying investments (typically $50,000 or more) in a Precious Metals IRA make you eligible for the bonus.

- The free silver is delivered to your depository as part of your IRA or shipped to you directly if you’re making a personal purchase.

- Customer Perception:

- Customers appreciate the value of the silver bonus, especially for larger accounts. It’s a tangible reward for committing to a serious investment.

American Hartford Gold

- What They Offer:

- American Hartford Gold also offers free silver, but their promotions are often tied to both IRA rollovers and direct purchases.

- The exact amount varies based on the size of your investment, but it’s typically up to $5,000 worth of silver for qualifying accounts.

- How It Works:

- Promotions are flexible and tailored during your consultation, so the specifics of the offer depend on your investment size.

- Customer Perception:

- While the free silver is appreciated, some customers note that the exact terms of the promotion aren’t always clearly spelled out until they speak with a representative.

Comparison: If you’re rolling over a larger IRA, Goldco’s $10,000 silver bonus makes them the better pick for high-value accounts. For smaller investors, American Hartford Gold offers more accessible silver bonuses.

Fee Waivers for IRAs

Goldco

- What They Offer:

- Goldco does not waive setup, maintenance, or storage fees for IRAs, but their fees are competitively priced and fully disclosed.

- They focus more on offering value through their silver promotions rather than waiving upfront costs.

- Key Details:

- $50 one-time setup fee.

- $80 annual maintenance fee.

- $100–$150 annual storage fee, depending on your depository choice.

American Hartford Gold

- What They Offer:

- American Hartford Gold shines here by waiving all IRA fees for the first year. This includes setup fees, storage fees, and annual maintenance fees.

- For larger accounts, they may extend the waiver beyond the first year as part of their promotions.

- Key Details:

- After the first year, fees are standard for the industry ($100–$150 for storage, $75–$150 for maintenance).

- Customer Perception:

- First-year fee waivers are a big draw for first-time investors who want to save money upfront.

Comparison: If you’re looking to minimize your initial costs, American Hartford Gold’s fee waivers are hard to beat. Goldco’s focus on transparency and competitive long-term fees make them more appealing for investors prioritizing consistent pricing over upfront perks.

Promotions for Direct Purchases

Goldco

- Focus on IRAs:

- While Goldco does cater to direct purchases of gold and silver, their promotions are primarily geared toward IRA rollovers.

- Limited Direct Purchase Perks:

- Free silver bonuses are occasionally available for large direct purchases, but the bulk of their promotional energy is IRA-focused.

- Customer Perception:

- Customers making direct purchases appreciate Goldco’s competitive pricing, but they often wish for more perks outside of IRAs.

American Hartford Gold

- Focus on Flexibility:

- American Hartford Gold actively promotes perks for direct purchases, making them a strong option for non-IRA investors.

- Offers include free shipping, free silver bonuses, and even price-match guarantees.

- Shipping Perks:

- Free shipping is standard for direct purchases, and all orders are fully insured and discreetly packaged.

- Customer Perception:

- Non-IRA investors frequently praise American Hartford Gold for its flexibility and tailored promotions.

Comparison: For direct purchases, American Hartford Gold has the edge with its shipping perks and price-match guarantee, while Goldco’s perks are IRA-centric.

Price Match Guarantee

Goldco

- No Price Match Guarantee:

- Goldco focuses on transparency and competitive pricing but does not offer an official price-match guarantee.

American Hartford Gold

- Yes, Price Match Guarantee:

- American Hartford Gold promises to match or beat competitor pricing on precious metals.

- This applies to both IRA purchases and direct purchases, ensuring you get the best deal available.

- Customer Perception:

- Customers appreciate the peace of mind that comes with knowing they won’t overpay for their investment.

Comparison: American Hartford Gold’s price match guarantee makes it the winner here, particularly if you’re shopping around and want the best deal.

Educational Resources and Support

Goldco

- What They Offer:

- Goldco provides free consultations with experienced account managers who specialize in educating clients on Precious Metals IRAs.

- Their educational kits and materials are some of the best in the industry, offering in-depth insights into inflation, market volatility, and the benefits of precious metals.

- Customer Perception:

- Customers value the detailed, patient approach Goldco takes, particularly for first-time investors.

American Hartford Gold

- What They Offer:

- American Hartford Gold offers free informational kits and resources on investing in precious metals.

- Their educational focus is slightly broader, catering to both IRA investors and those purchasing metals for home storage.

- Customer Perception:

- Customers appreciate the guides, though some note that the company leans more toward encouraging purchases than pure education.

Comparison: Both companies provide strong educational resources, but Goldco’s focus on in-depth IRA education gives them a slight edge.

Minimum Investment Requirements

Goldco

- Minimum Investment:

- $25,000 for IRA accounts, which is higher than some competitors but reflects their focus on serious, long-term investors.

- No minimum for direct purchases.

- Customer Perception:

- Some smaller investors feel excluded by the high IRA minimum, though Goldco’s perks for larger accounts make it worthwhile.

American Hartford Gold

- Minimum Investment:

- No stated minimum for IRAs or direct purchases, making it more accessible for first-time or smaller investors.

- Customer Perception:

- Customers love the flexibility, especially those looking to start small.

Comparison: American Hartford Gold’s no-minimum policy makes it the better choice for smaller investors, while Goldco is better suited for larger accounts.

Final Comparison: Promotions and Perks

| Category | Goldco | American Hartford Gold |

| Free Precious Metals | Up to $10,000 in free silver for large IRAs. | Up to $5,000 in free silver for IRAs and purchases. |

| Fee Waivers | No fee waivers, but transparent pricing. | First-year fees waived for IRAs. |

| Direct Purchase Perks | Limited to free silver for large purchases. | Free shipping, price match guarantee, and silver bonuses. |

| Price Match Guarantee | Not offered. | Yes, on all precious metals. |

| Educational Resources | Highly detailed, focused on IRAs. | Strong but slightly more sales-oriented. |

| Minimum Investment | $25,000 for IRAs, no minimum for purchases. | No minimum for IRAs or purchases. |

The Bottom Line

- Choose Goldco if:

- You’re rolling over a large IRA (over $25,000) and want the biggest silver bonus.

- You value education and a no-pressure, highly transparent approach.

- You’re focused on long-term investing and don’t mind paying fees upfront for clarity and service.

- Choose American Hartford Gold if:

- You’re a first-time investor or want to save on fees with their first-year IRA waivers.

- You’re making direct purchases and value perks like free shipping and price-match guarantees.

- You want flexibility and accessibility with no minimum investment requirements.

Goldco vs American Hartford Gold: Conclusion

Both companies are rock-solid choices, but the best one for you will depend on your specific needs. Either way, you’re making a smart move by turning to precious metals—it’s the kind of financial security that outlasts stock market crashes, inflation, and even the bad decisions of modern politicians. Now, go protect your wealth like the boss you are.