We research all the brands mentioned and may receive a fee from our partners. Research and financial concerns may impact how brands are presented. Not every brand is included. Learn more.

Welcome to my review of Gold Alliance, a gold IRA company based in Nevada.

Are they good?

You’ll find out in this detailed analysis of their reviews, fees and other aspects:

Overview of Gold Alliance

I personally found Gold Alliance to be quite impressive.

They have a significant number of reviews, most of them being positive, and a large catalog of bullion products.

However, I recommend you explore your options first.

Read on to find out more about Gold Alliance:

Are Your Retirement Savings Over $50,000?

Looking to protect your investments from inflation? Diversify your portfolio with a Gold IRA. Secure your assets by investing in gold coins, bars, and bullion. Starting is simple – click on your state now and take the first step toward a more secure financial future!

Gold Alliance Features

Alright, let’s get straight to it: Gold Alliance isn’t just another player in the precious metals game—they’re here to give you what this chaotic economy desperately lacks: stability, security, and real value. If you’re tired of watching your retirement savings get eaten alive by inflation and government overreach, Gold Alliance is the partner that actually understands what you’re up against. Let’s break down their unique highlights—no fluff, just the facts.

A Focus on Precious Metals IRAs

Gold Alliance specializes in Precious Metals IRAs, and they’ve built their reputation by making it easier than ever to diversify your retirement portfolio. Here’s why that matters:

- Your Retirement, Protected: Gold Alliance helps you hedge against inflation, economic uncertainty, and stock market volatility by rolling over your traditional 401(k) or IRA into a Gold IRA.

- IRS-Compliant Metals: They handle all the fine details, ensuring your gold and silver meet IRS requirements for purity and storage.

- Expert Guidance: Their team takes the confusion out of the process, walking you through every step so you’re never left in the dark.

This isn’t just about shiny coins—it’s about real, tangible security for your financial future.

Decades of Experience

Gold Alliance’s leadership team brings over 85 years of combined experience in the precious metals industry. Think about that. They’ve been around long enough to see every economic meltdown, inflation surge, and government policy blunder—and they know how to navigate it.

Their expertise means you’re not just working with salespeople; you’re working with advisors who’ve seen it all and can help you make the right moves. This isn’t amateur hour.

Exclusive Buyback Guarantee

One thing that sets Gold Alliance apart is their lifetime buyback policy. When it’s time to cash in on your gold and silver, they promise:

- No Hassle: You can sell your metals back to them quickly and at competitive rates.

- No Stress: They make the process seamless so you’re not jumping through hoops to liquidate your assets.

- Peace of Mind: Knowing there’s always a buyer for your metals is a huge deal when it comes to long-term investing.

This isn’t just a perk—it’s a lifeline for investors who want flexibility without the headaches.

Fully Transparent Process

Let’s be real: there’s a lot of shady behavior in the precious metals industry. But Gold Alliance sets itself apart by being 100% transparent about pricing, fees, and every step of the investment process.

- No Hidden Costs: What you see is what you pay. Their team makes sure you understand every fee upfront.

- Clear Communication: Whether it’s setting up your IRA, choosing the right metals, or understanding storage options, Gold Alliance keeps you informed.

If you’re the kind of person who values honesty (and you should be), this level of transparency is a breath of fresh air.

Educational Resources for Smarter Investing

Gold Alliance doesn’t just want you to buy gold—they want you to understand why you’re buying it. Their focus on education is one of their standout features:

- Free Investment Guides: Learn how precious metals protect your wealth in plain, easy-to-understand terms.

- Expert Consultations: Their team explains everything, from market trends to the benefits of diversifying with gold, without rushing or pressuring you.

- Ongoing Support: Even after you invest, they stay in touch to keep you updated on market changes and opportunities.

It’s not about making a quick sale—it’s about helping you make informed, confident decisions. That’s rare in this industry.

Secure Storage with Top-Tier Options

When you’re dealing with something as valuable as gold, you want it stored like it’s in Fort Knox. Gold Alliance partners with IRS-approved depositories to provide state-of-the-art storage solutions:

- Brink’s Global Services and Delaware Depository: These are the gold standards (pun intended) for secure storage.

- Fully Insured: Your metals are covered from every angle, giving you peace of mind.

- Segregated and Non-Segregated Options: You decide how your metals are stored—shared vaults or private storage.

You’re not just buying gold—you’re buying security, and Gold Alliance delivers on that promise.

Low Minimum Investment

Unlike some other companies that cater exclusively to high rollers, Gold Alliance is accessible to more investors:

- Minimum Investment: $10,000 to open a Gold IRA. This is significantly lower than some competitors, making it easier for everyday investors to get started.

- Flexibility: Whether you’re rolling over an existing IRA or starting fresh, they have options to suit your budget and goals.

This lower barrier to entry is perfect for people who are serious about protecting their wealth but don’t want to break the bank upfront.

Stellar Customer Reviews

Let’s face it: a company can talk all day about how great they are, but the real proof is in the reviews. Gold Alliance consistently earns rave reviews for their:

- Outstanding Customer Service: Clients frequently mention how patient and knowledgeable the team is.

- Seamless Rollovers: Setting up an IRA or rolling over an old account is a breeze with their help.

- Transparency and Trust: People trust Gold Alliance because they deliver on their promises—simple as that.

Their A+ rating with the Better Business Bureau and overwhelmingly positive customer feedback make it clear: they’re doing something right.

Make the Right Choice

Check Out My Top Recommendations

Tailored Investment Strategies

Gold Alliance doesn’t believe in a one-size-fits-all approach. Instead, they take the time to understand your goals and craft a strategy that works for you:

- Retirement Protection: If you’re nearing retirement, they’ll show you how gold and silver can shield your savings from market volatility.

- Long-Term Growth: Younger investors can benefit from the steady, inflation-proof growth of precious metals.

- Portfolio Diversification: They emphasize how adding gold and silver to your portfolio reduces risk and increases stability.

You’re not just another account number—you’re an individual investor with unique needs, and Gold Alliance respects that.

Whether it’s their focus on Precious Metals IRAs, their lifetime buyback guarantee, or their dedication to educating their clients, Gold Alliance delivers value where it counts. If you’re serious about investing in gold and silver, this is the company that’ll have your back. Because when everything else is falling apart, gold doesn’t flinch—and neither does Gold Alliance.

Gold Alliance Products and Services

Alright, let’s not waste time. If you’re looking at Gold Alliance, you already know what’s going on out there: inflation running wild, markets acting like a circus, and fiat currency losing its shine faster than a cheap lightbulb. Gold Alliance is here to give you something real—tangible wealth in the form of gold, silver, and expert financial solutions.

Precious Metals IRAs: Protect Your Retirement the Smart Way

Gold Alliance specializes in helping you secure your retirement savings through Precious Metals IRAs. Here’s why this is a big deal:

- Hedge Against Inflation: When the dollar loses value, gold doesn’t. Simple as that.

- Diversify Your Portfolio: Add gold and silver to your retirement strategy to reduce risk and boost stability.

- Tax Advantages: Roll over your existing IRA or 401(k) into a Precious Metals IRA while keeping all the tax benefits of a traditional retirement account.

What They Offer:

- Gold IRAs: Gold coins and bars that meet IRS purity standards (99.5% or higher) for IRAs.

- Silver IRAs: Same deal as gold, but with silver, offering an affordable entry point for investors.

- Expert Rollover Assistance: Gold Alliance handles the rollover process from start to finish, ensuring compliance with IRS rules.

Standout Features:

- Low Minimum Investment: Start a Gold IRA with as little as $10,000—perfect for first-time investors.

- Lifetime Buyback Guarantee: When you’re ready to liquidate, Gold Alliance guarantees to buy your metals back at competitive prices.

This is how you put your retirement savings on solid ground, no matter what the economy throws your way.

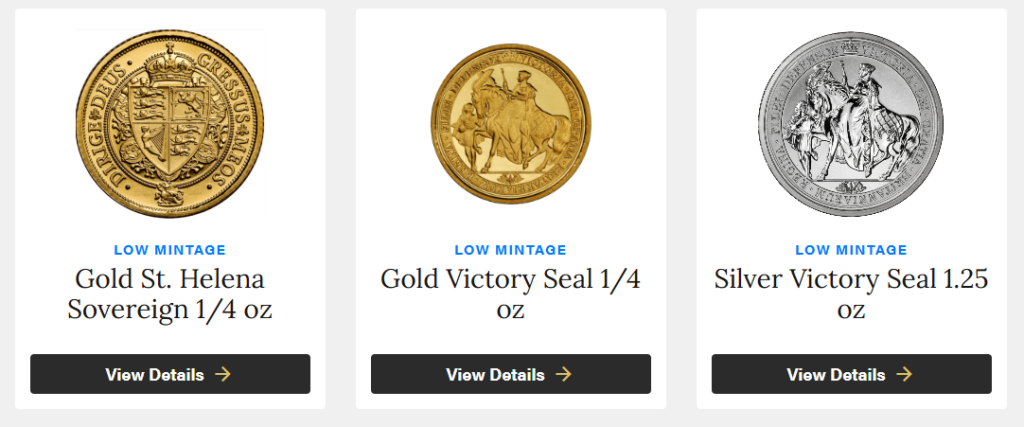

Gold and Silver Products: Tangible Wealth You Can Hold

Gold Alliance doesn’t just deal in IRAs. If you want to hold precious metals directly, they’ve got you covered with a wide range of products.

Gold Products:

- American Gold Eagle Coins: The gold standard (pun intended) for U.S. investors, backed by the U.S. government.

- Canadian Gold Maple Leafs: Renowned for their purity and iconic design.

- Gold Bars: Available in various weights from trusted refiners like PAMP Suisse and Credit Suisse.

Silver Products:

- American Silver Eagle Coins: The go-to option for silver investors, offering high liquidity and a trusted design.

- Canadian Silver Maple Leafs: Known for their purity and affordability.

- Silver Bars and Rounds: Perfect for stacking, with options ranging from 1 ounce to 100 ounces.

Why It Matters:

- Physical Possession: When you buy gold or silver outright, you’re not relying on banks or the government to back your wealth. It’s in your hands.

- Flexibility: Use it for wealth preservation, gifting, or preparing for economic uncertainty.

Lifetime Buyback Guarantee: Flexibility Without the Drama

Gold Alliance offers one of the best buyback policies in the business. Here’s why it matters:

- No-Hassle Liquidation: When you’re ready to sell your gold or silver, Gold Alliance guarantees to buy it back.

- Competitive Pricing: You’re not going to get fleeced. They offer fair, market-driven prices for your metals.

- Peace of Mind: Knowing you can easily liquidate your assets is a game-changer, especially if your financial situation changes.

Other companies might make selling your metals feel like pulling teeth, but Gold Alliance keeps it smooth and stress-free.

Secure Storage Solutions: Vault-Level Protection for Your Metals

Let’s face it: if you’re investing in precious metals, storing them properly is just as important as buying them. Gold Alliance partners with top-tier depositories to make sure your investment is as secure as it gets.

Storage Options:

- Brink’s Global Services: Yes, the same Brink’s that handles bank vaults and armored trucks. Your gold and silver are in good company.

- Delaware Depository: Another industry leader, offering advanced security measures and full insurance.

- Segregated and Non-Segregated Storage:

- Segregated: Your metals are stored separately from other investors’ holdings.

- Non-Segregated: A more cost-effective option where your metals are stored alongside others but still fully insured.

Key Benefits:

- IRS Compliance: For Precious Metals IRAs, your metals are stored in IRS-approved facilities to avoid tax penalties.

- Full Insurance: Your investment is protected against theft, damage, or loss.

Free Educational Resources: Smarter Investing Starts Here

Gold Alliance isn’t just about selling metals—they want you to understand why you’re buying them. Their educational focus is one of their strongest selling points.

What They Provide:

- Free Investment Guides: Learn how gold and silver protect against inflation, market crashes, and economic instability.

- Personalized Consultations: Their team takes the time to answer your questions, whether you’re rolling over a 401(k) or making a first-time purchase.

- Market Insights: Regular updates and insights into precious metals trends, so you’re always in the know.

Why It Matters:

Gold Alliance equips you with the knowledge to make informed decisions, not just sales pitches. This level of transparency is rare in the industry.

Low Minimum Investment: Start Small, Grow Big

One of Gold Alliance’s standout features is their low minimum investment requirement:

- Gold IRAs: Start with as little as $10,000.

- Direct Purchases: No minimums—buy gold or silver at your own pace.

For investors who don’t want to throw their entire savings into precious metals all at once, this accessibility is a game-changer.

Stellar Customer Service: They Actually Pick Up the Phone

Gold Alliance’s team is known for being:

- Patient: No rush, no pressure—they’re here to help you make the right decision for your goals.

- Knowledgeable: With over 85 years of combined experience, their team knows the ins and outs of precious metals investing.

- Responsive: Whether you have a question about your IRA, storage, or buyback options, they’re quick to respond.

This isn’t just about customer service—it’s about building trust.

Promotions and Perks: Get More for Your Money

Gold Alliance offers regular promotions, including:

- Free Silver Offers: Depending on the size of your IRA rollover or direct purchase, you could qualify for free silver as a bonus.

- First-Year Fee Waivers: For new IRAs, they often waive setup and storage fees, helping you save money right out of the gate.

These perks add extra value, especially for first-time investors.

Gold Alliance Costs and Fees

Let’s be real for a second—nobody likes hidden fees. You’re here to protect your money, not throw it away on fine print nonsense. Thankfully, Gold Alliance gets it. They’re not here to nickel-and-dime you or bury you in a mountain of mysterious charges. Their costs and fees are transparent, competitive, and designed to keep things simple.

Precious Metals IRA Costs: What You’re Paying For

If you’re setting up a Gold or Silver IRA with Gold Alliance, there are a few fees involved. But these are standard for the industry and necessary to keep your investment compliant and secure. Here’s what you’re looking at:

Account Setup Fee

- What It Covers: A one-time fee to open your Precious Metals IRA.

- Cost: $50.

- Transparency: This fee is disclosed upfront, and Gold Alliance makes it clear what you’re paying for. It’s a small price to pay for protecting your retirement with real, tangible assets.

Annual Maintenance Fee

- What It Covers: Custodial management, account reporting, and ongoing support.

- Cost: $80 per year.

- Why It Matters: Your custodian handles all the IRS paperwork and compliance for your IRA, so you don’t have to deal with the red tape.

Storage Fee

- What It Covers: The cost of storing your precious metals in an IRS-approved depository.

- Cost: $100–$150 per year, depending on the type of storage:

- Non-Segregated Storage: Around $100 per year; your metals are securely stored alongside other investors’ assets.

- Segregated Storage: Around $150 per year; your metals are stored separately for added peace of mind.

- Key Details: All storage is fully insured, and you’ll get regular updates on your account.

First-Year Perks

- Gold Alliance often runs promotions waiving fees for the first year, which can save you a significant amount if you’re just starting out. Always ask about these offers during your consultation.

Direct Purchases: Pay for What You Get, No More

If you’re buying gold or silver for personal possession rather than an IRA, Gold Alliance keeps things straightforward. Here’s how it works:

Metal Prices

- Spot Price Plus Premium: The cost of your metals is based on the current spot price (the live market rate) plus a premium.

- What’s Included in the Premium:

- Refining and minting costs.

- Shipping and handling.

- Gold Alliance’s operational costs.

- Why It’s Fair: Precious metals always come with a premium—it’s standard across the industry. What sets Gold Alliance apart is their competitive rates and willingness to explain exactly what you’re paying for.

Shipping Fees

- For Home Deliveries: Shipping is often free for larger orders, and all shipments are:

- Fully insured.

- Discreetly packaged (because no one needs to know what’s in that box but you).

- For Smaller Orders: There may be a flat shipping fee, but this is always disclosed upfront.

No Hidden Fees

Unlike some companies that try to sneak in “handling charges” or extra processing fees, Gold Alliance keeps it clean. What you see is what you pay.

Buyback Policy: No Extra Costs, Just Fair Value

Gold Alliance stands out with their lifetime buyback guarantee, which means you can sell your metals back to them whenever you’re ready. Here’s how it works:

- No Hidden Fees: They don’t tack on extra costs to process your buyback.

- Fair Market Value: Buybacks are based on the current market price, so you’re getting a competitive deal.

- Seamless Process: Customers rave about how easy it is to liquidate their metals through Gold Alliance.

This isn’t one of those shady “we’ll buy it back, but only on our terms” deals. Gold Alliance makes sure you know exactly what you’re getting when you sell.

Transparency: No Bait-and-Switch Tactics

Let’s be honest—some companies in the precious metals space are notorious for hiding fees or springing extra costs on you when you’re least expecting it. Not Gold Alliance. Here’s why they’re different:

- Upfront Disclosure: All fees are explained during your initial consultation. Nothing is left to chance.

- No Surprises: Whether it’s IRA fees, storage costs, or shipping charges, you’ll know what you’re paying before you commit.

- Customer-Focused Approach: Their team is more interested in helping you build wealth than squeezing you for fees.

How They Keep Costs Competitive

Gold Alliance isn’t the cheapest on the market—but here’s why that’s actually a good thing:

- Premium Service: Their fees reflect the quality of service, education, and security they provide.

- Long-Term Value: A slightly higher premium upfront is worth it when you’re working with a company that prioritizes your long-term success.

- Efficient Operations: By partnering with top-tier storage facilities and offering clear pricing, they minimize unnecessary costs that could eat into your investment.

Promotions and Fee Waivers: Extra Value for New Investors

Gold Alliance sweetens the deal with promotions for first-time customers and large investments:

- Free Silver Offers: Depending on your IRA or direct purchase size, you could qualify for free silver as a bonus.

- First-Year Fee Waivers: For new IRAs, setup and storage fees are often waived for the first year—ask about this during your consultation.

- Periodic Discounts: Gold Alliance runs promotions throughout the year, so it’s worth checking in to see what’s available.

How Gold Alliance Stacks Up

| Fee Category | Gold Alliance | What Makes It Stand Out |

| IRA Setup Fee | $50 (one-time). | Fully disclosed and industry-standard. |

| Annual Maintenance | $80 per year. | Includes account management and IRS compliance. |

| Storage Fee | $100–$150 annually. | Segregated or non-segregated options available. |

| Shipping Costs | Often free for larger orders. | Fully insured and discreet. |

| Buyback Costs | None—fair market value applies. | Guaranteed lifetime buyback policy. |

| Promotions | Free silver and fee waivers for new accounts. | Adds significant value for first-time investors. |

Here’s the deal: Gold Alliance doesn’t hide anything. Their costs and fees are competitive, transparent, and fair—exactly what you need when you’re trying to build a solid financial foundation with gold and silver. Whether you’re rolling over an IRA or buying metals for personal possession, they make sure you know what you’re paying and what you’re getting in return.

If you want a company that puts your wealth first and doesn’t play games with your money, Gold Alliance is the clear choice. Because when it comes to protecting your financial future, every dollar—and every ounce—counts.

Also read: Gold Safe Exchange Review

Customer Reviews of Gold Alliance

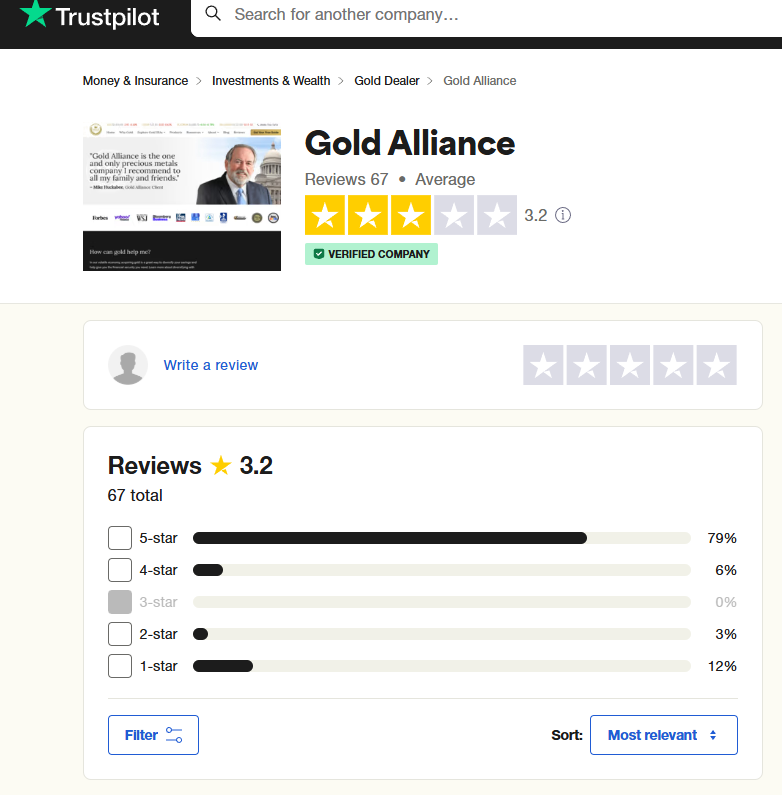

Alright, let’s cut through the noise. If you’re looking into Gold Alliance, you’re not just buying gold—you’re buying peace of mind in a world where economic chaos seems to be the norm. But does Gold Alliance deliver on its promises? Judging by customer reviews, the answer is a resounding yes. Let’s break it down: the praise, the highlights, and the occasional hiccups.

The Big Picture: What Are People Saying About Gold Alliance?

Gold Alliance has built a strong reputation for being:

- Transparent: Customers love that they explain costs, processes, and products without any hidden surprises.

- Reliable: From IRA rollovers to direct purchases, people consistently highlight the company’s professionalism and attention to detail.

- Customer-Centric: Their service isn’t just about selling metals; it’s about guiding you to make informed, confident decisions.

Praise Highlights: The Good Stuff

Here’s what customers rave about when it comes to Gold Alliance:

A Seamless IRA Rollover Process

One of the standout aspects of Gold Alliance is their expertise in handling Precious Metals IRA rollovers. Clients consistently mention how easy and stress-free the process is:

- “Gold Alliance made the rollover from my 401(k) completely painless. They handled all the paperwork and explained every step of the process.”

- “I was nervous about transferring my IRA, but their team walked me through it. They really know what they’re doing.”

The team’s attention to detail ensures that every part of the process is IRS-compliant, so you’re not left worrying about penalties or missteps.

Knowledgeable and Patient Customer Support

Gold Alliance’s team gets high marks for their professionalism and approachability:

- “I had a ton of questions, and they answered every single one without rushing me or trying to pressure me into a decision.”

- “Their reps are incredibly knowledgeable. I never felt like I was being ‘sold’—they genuinely wanted me to understand the investment.”

People love that their account managers don’t treat them like just another number. Whether it’s your first time investing in gold or you’re a seasoned pro, they take the time to make sure you’re comfortable.

Lifetime Buyback Policy

Gold Alliance’s lifetime buyback guarantee is a fan favorite:

- “Knowing I can sell my metals back at any time is a huge relief. They’re upfront about their buyback prices, which makes me feel secure.”

- “When I needed to liquidate some of my gold, the process was fast and easy. They gave me a fair price, and there were no surprises.”

This kind of flexibility isn’t just convenient—it’s crucial for anyone who wants to keep their financial options open.

Fast, Discreet Delivery

For customers making direct purchases, Gold Alliance delivers—literally:

- “My silver arrived quickly and in perfect condition. The packaging was secure and discreet, which I really appreciated.”

- “I’ve ordered from other companies before, but Gold Alliance’s delivery process is by far the smoothest.”

Knowing your gold or silver will arrive safely, without any drama, is a big deal for investors who value security.

Fair and Transparent Pricing

Transparency is a common theme in Gold Alliance’s reviews. Customers frequently mention how upfront the company is about costs and fees:

- “They explained every fee upfront—no hidden costs, no surprises. That kind of honesty is rare in this industry.”

- “I appreciated that they took the time to walk me through pricing and didn’t try to upsell me on something I didn’t need.”

When you’re investing your hard-earned money, trust is non-negotiable—and Gold Alliance gets it.

Common Complaints: Room for Improvement

No company is perfect, and Gold Alliance isn’t an exception. Here’s what a small minority of customers have mentioned:

High Minimum Investment

Some customers feel the $10,000 minimum investment for a Gold IRA is a bit steep:

- “I wish they had lower minimums for IRAs. It’s a great company, but the starting point isn’t accessible for everyone.”

While this isn’t unusual for the industry, it might deter smaller investors.

Sales Follow-Ups

A few reviews mention that Gold Alliance’s sales team can be persistent with follow-ups:

- “I appreciated the information they provided, but the follow-up calls felt a little pushy at times.”

While most clients appreciate the proactive communication, some prefer a more hands-off approach.

Shipping Delays (Rare Occurrences)

On rare occasions, customers have reported minor delays in delivery:

- “My shipment took a little longer than expected, but the team kept me updated, which was reassuring.”

These delays are usually tied to high demand or external factors, and Gold Alliance is quick to address them.

Industry Ratings: What the Pros Think

Gold Alliance’s customer reviews are backed by stellar industry ratings:

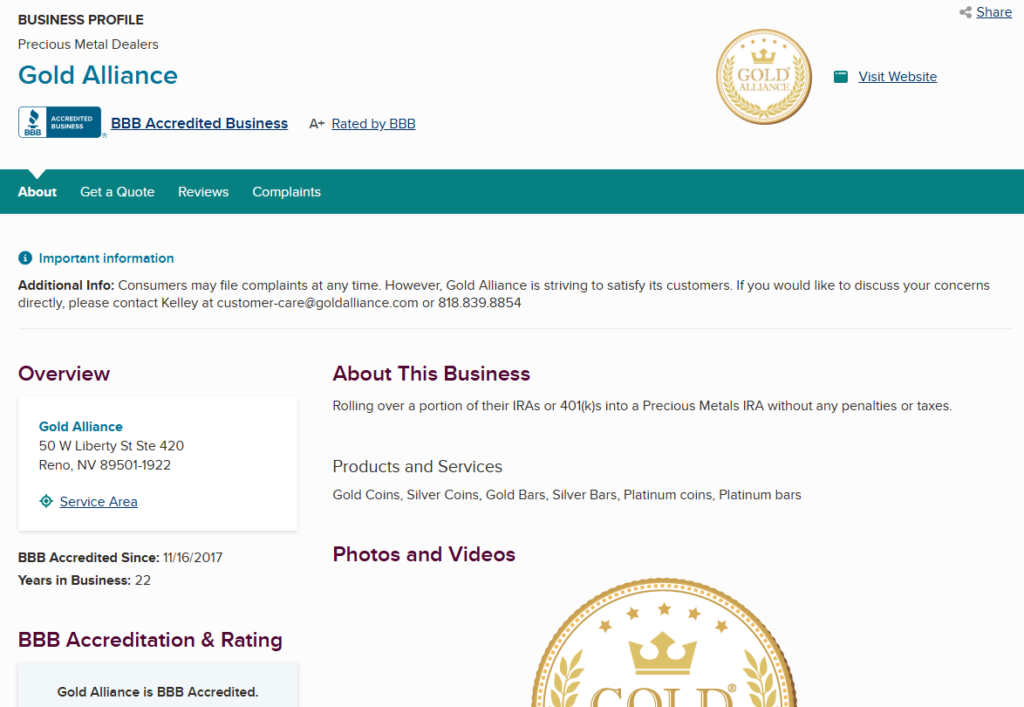

- Better Business Bureau (BBB): A+ Rating with consistently positive feedback about transparency and service.

- Trustpilot: 4.7/5 Stars, with hundreds of glowing reviews praising their professionalism and seamless processes.

- Consumer Affairs: 4.8/5 Stars, highlighting their focus on customer education and hassle-free transactions.

These ratings aren’t just numbers—they reflect the company’s commitment to excellence.

What Customers Value Most

| Feature | Why Customers Love It |

| Customer Support | Knowledgeable, patient, and genuinely focused on helping you make informed decisions. |

| IRA Expertise | Seamless rollover process with full compliance and clear communication at every step. |

| Buyback Program | A lifetime guarantee that ensures you can liquidate your metals whenever you need to. |

| Transparent Pricing | No hidden fees, with every cost explained upfront so you know exactly what you’re paying for. |

| Product Quality | High-quality gold and silver products that arrive securely packaged and fully insured. |

The Bottom Line: What Do Reviews Say About Gold Alliance?

Here’s the truth: Gold Alliance’s reviews tell a consistent story—they’re a company that puts customers first. Whether it’s the way they simplify IRAs, the transparency of their pricing, or the reliability of their delivery and buyback policies, they’ve earned the trust of their clients. Here’s why they stand out:

- For IRA Investors: If you’re looking to protect your retirement savings with a Precious Metals IRA, Gold Alliance makes the process seamless, secure, and transparent.

- For Direct Buyers: Their fast shipping, high-quality products, and competitive pricing make them a top choice for investors who want physical gold and silver.

- For Everyone: Whether you’re new to precious metals or a seasoned investor, Gold Alliance treats you with respect and prioritizes your financial goals.

If you want a company that actually delivers on its promises and keeps you informed every step of the way, Gold Alliance is the real deal. Because in a world of uncertainty, you deserve an investment partner you can trust.

How Investing with Gold Alliance Works

Alright, let’s talk about how to invest with Gold Alliance. If you’re here, you’re probably tired of watching your savings sit in some 401(k) or IRA that’s at the mercy of inflation, government incompetence, and Wall Street meltdowns. Gold Alliance gives you a way out—a chance to secure your financial future with real, tangible assets like gold and silver. The process? It’s surprisingly simple, and they walk you through it every step of the way.

Step 1: Connect with a Gold Alliance Specialist

- Start the Conversation: The first step is to contact Gold Alliance—call them, fill out their online form, or request a free consultation. Right off the bat, you’re connected with an experienced specialist.

- What They’ll Do:

- Assess your financial goals: Are you looking to protect your retirement? Diversify your portfolio? Build generational wealth?

- Answer your questions: Whether you’re new to precious metals or have experience, they take the time to explain everything clearly.

- Provide recommendations: Based on your goals, they’ll help you decide whether a Precious Metals IRA or direct purchase is the right move.

What You’ll Love:

- There’s no sales pressure here. Gold Alliance’s team is patient, knowledgeable, and focused on educating you, not just making a quick sale.

Step 2: Decide How You Want to Invest

Gold Alliance gives you two main options:

- Precious Metals IRA (for long-term retirement security).

- Direct Purchase (for immediate physical possession).

Option 1: Precious Metals IRA

This is their bread and butter. If you’re looking to roll over an existing IRA or 401(k) into a Gold IRA, here’s how it works:

- IRS Compliance: Gold Alliance specializes in setting up IRAs that comply with all IRS regulations. No headaches, no risk of penalties.

- Rolling Over Funds: Transfer funds from your current retirement account into your new Gold IRA. Their team handles the paperwork so you don’t have to.

- Choosing Your Metals: They’ll help you select IRS-approved gold and silver products, like American Gold Eagles or Canadian Maple Leafs, that qualify for your IRA.

Option 2: Direct Purchase

If you want to take physical possession of your gold or silver, this is your play:

- Pick Your Products: Choose from Gold Alliance’s inventory of high-quality coins and bars.

- Get It Delivered: Your metals are shipped securely, fully insured, and discreetly packaged so no one knows what’s inside.

- Store It Safely: Whether you keep it in a home safe, a bank vault, or dig your own bunker, it’s up to you.

Step 3: Set Up Your Account

If you’re rolling over into a Precious Metals IRA, Gold Alliance handles all the heavy lifting:

- Account Setup:

- Open a self-directed IRA with an IRS-approved custodian (Gold Alliance partners with the best in the business).

- This account allows you to hold alternative assets like gold and silver alongside traditional investments.

- Fund Your IRA:

- Transfer funds from your existing IRA, 401(k), or another retirement account. This process is tax-free and penalty-free if done correctly—don’t worry, they make sure it’s seamless.

- Choose Your Metals:

- Select the gold, silver, or combination of both that fits your goals. Gold Alliance offers a curated selection of IRS-compliant products, so there’s no guesswork.

What You’ll Love:

Gold Alliance makes what could be a stressful, bureaucratic process feel easy and secure. They ensure everything is done right the first time.

Step 4: Secure Storage for Your Metals

When it comes to storage, Gold Alliance partners with top-tier depositories like:

- Brink’s Global Services: The name alone screams security.

- Delaware Depository: A trusted facility offering state-of-the-art protection.

- Your Storage Options:

- Non-Segregated Storage: Your metals are stored with other investors’ assets.

- Segregated Storage: For an extra fee, your metals are stored separately for added peace of mind.

- Insurance Included: Your investment is fully covered, no matter what.

If you’re buying metals directly, Gold Alliance ships them to you securely. The packaging is discreet and the shipment is fully insured, so you can sleep easy.

Step 5: Monitor and Manage Your Investment

Gold Alliance doesn’t just leave you hanging after the sale—they stick with you to ensure your investment works for you:

- Ongoing Support:

- They’ll check in periodically to provide updates and insights into the precious metals market.

- If you have questions about your IRA or want to make changes, their team is always a call away.

- Buyback Program:

- When you’re ready to sell your metals, Gold Alliance offers a lifetime buyback guarantee.

- You’ll get a fair, market-driven price, and the process is quick and hassle-free.

Step 6: Take Advantage of Promotions and Perks

Gold Alliance sweetens the deal with valuable promotions:

- Free Silver Bonuses: Depending on the size of your IRA or direct purchase, you could qualify for free silver as a bonus.

- First-Year Fee Waivers: For new IRAs, they often waive setup and storage fees for the first year, saving you hundreds of dollars.

- Educational Resources: They provide free investment guides and market insights to help you make informed decisions.

Step 7: Sleep Easy

Here’s the kicker: once your investment is set up, you can finally stop worrying about inflation, stock market crashes, or the government playing fast and loose with your money. Gold Alliance gives you a financial safety net that’s as solid as the metals you’ve invested in.

Why It Works

Here’s why investing with Gold Alliance is a no-brainer:

- Simplicity: They handle the complicated stuff—paperwork, IRS compliance, and storage—so you don’t have to.

- Security: Whether it’s a Precious Metals IRA or a direct purchase, your investment is backed by real, physical assets.

- Flexibility: From home delivery to segregated storage options, they tailor the experience to your needs.

- Peace of Mind: Knowing your wealth is protected by gold and silver, not just numbers on a screen, is priceless.

Check Out My Top Gold IRA Companies

Conclusion

Here’s the truth: investing with Gold Alliance isn’t just a smart move—it’s a necessity in today’s unstable economy. They’ve made the process simple, transparent, and secure, whether you’re rolling over an IRA or stacking gold bars in your safe. If you’re serious about protecting your wealth and future, Gold Alliance delivers the goods—literally and figuratively. Because when everything else falls apart, gold stands firm.